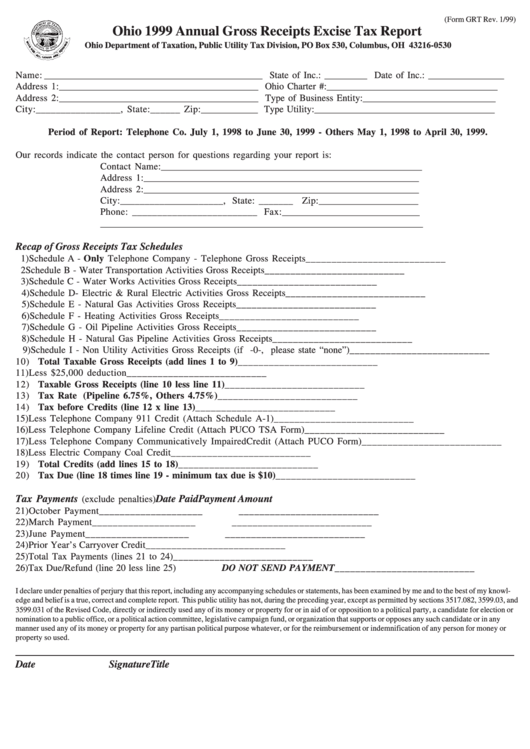

(Form GRT Rev. 1/99)

Ohio 1999 Annual Gross Receipts Excise Tax Report

Ohio Department of Taxation, Public Utility Tax Division, PO Box 530, Columbus, OH 43216-0530

Name: ______________________________________________ State of Inc.: _________ Date of Inc.: ________________

Address 1: __________________________________________ Ohio Charter #: ____________________________________

Address 2: __________________________________________ Type of Business Entity: ____________________________

City:_________________, State:______ Zip: ____________ Type Utility: ______________________________________

Period of Report: Telephone Co. July 1, 1998 to June 30, 1999 - Others May 1, 1998 to April 30, 1999.

Our records indicate the contact person for questions regarding your report is:

Contact Name: _______________________________________________________

Address 1: __________________________________________________________

Address 2: __________________________________________________________

City:_____________________, State: _______

Zip: _____________________

Phone: _________________________ Fax: _____________________________

____________________________________________________________________

Recap of Gross Receipts Tax Schedules

1) Schedule A - Only Telephone Company - Telephone Gross Receipts

___________________________

2

Schedule B - Water Transportation Activities Gross Receipts

___________________________

3) Schedule C - Water Works Activities Gross Receipts

___________________________

4) Schedule D- Electric & Rural Electric Activities Gross Receipts

___________________________

5) Schedule E - Natural Gas Activities Gross Receipts

___________________________

6) Schedule F - Heating Activities Gross Receipts

___________________________

7) Schedule G - Oil Pipeline Activities Gross Receipts

___________________________

8) Schedule H - Natural Gas Pipeline Activities Gross Receipts

___________________________

9) Schedule I - Non Utility Activities Gross Receipts (if -0-, please state “none”)

___________________________

10) Total Taxable Gross Receipts (add lines 1 to 9)

___________________________

11) Less $25,000 deduction

___________________________

12) Taxable Gross Receipts (line 10 less line 11)

___________________________

13) Tax Rate (Pipeline 6.75%, Others 4.75%)

___________________________

14) Tax before Credits (line 12 x line 13)

___________________________

15) Less Telephone Company 911 Credit (Attach Schedule A-1)

___________________________

16) Less Telephone Company Lifeline Credit (Attach PUCO TSA Form)

___________________________

17) Less Telephone Company Communicatively ImpairedCredit (Attach PUCO Form) ___________________________

18) Less Electric Company Coal Credit

___________________________

19) Total Credits (add lines 15 to 18)

___________________________

20) Tax Due (line 18 times line 19 - minimum tax due is $10)

___________________________

Tax Payments

Date Paid

Payment Amount

(exclude penalties)

21) October Payment

____________________

___________________________

22) March Payment

____________________

___________________________

23) June Payment

____________________

___________________________

24) Prior Year’s Carryover Credit

___________________________

25) Total Tax Payments (lines 21 to 24)

___________________________

26) Tax Due/Refund (line 20 less line 25)

DO NOT SEND PAYMENT

___________________________

I declare under penalties of perjury that this report, including any accompanying schedules or statements, has been examined by me and to the best of my knowl-

edge and belief is a true, correct and complete report. This public utility has not, during the preceding year, except as permitted by sections 3517.082, 3599.03, and

3599.031 of the Revised Code, directly or indirectly used any of its money or property for or in aid of or opposition to a political party, a candidate for election or

nomination to a public office, or a political action committee, legislative campaign fund, or organization that supports or opposes any such candidate or in any

manner used any of its money or property for any partisan political purpose whatever, or for the reimbursement or indemnification of any person for money or

property so used.

Date

Signature

Title

1

1