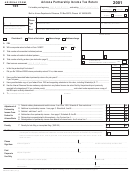

Form 165 (1998) Page 2

Business

List all places, both within and without Arizona, where the partnership carries on business.

Information

Description of place

Rented or owned

Street address

City and state

Principal product or service

(i.e. branch office, factory, etc.)

by partnership

Attach a schedule if there are more than four locations.

A1 Non-Arizona municipal bond interest ................................................................................

A1

Schedule A

00

A2 Other additions to partnership income - attach schedule ......................................

............

Additions

A2

00

to Partnership

Income

A3 Total additions to partnership income - add lines A1 and A2. Enter total here and on page 1, line 2 ............................

00

A3

B1

00

B1 Interest from U.S. government obligations .......................................................................

Schedule B

B2

00

B2 Difference in adjusted basis of property ...........................................................................

Subtractions

B3

00

B3 Agricultural crops charitable contribution. See instructions ..............................................

From

B4

00

B4 Alternative fuel vehicles and equipment ...........................................................................

Partnership

B5

00

B5 Other subtractions from partnership income - attach schedule ........................................

Income

B6

B6 Total subtractions from partnership income - add lines B1 through B5. Enter total here and on page 1, line 4 .............

00

Schedule C

The following information must be submitted by all partnerships having income

Apportionment

from sources both within and without Arizona. Average lines C1(a) through

Formula

C1(f). Arizona requires a double-weighted sales factor. See instructions on

(a)

(b)

(c)

(Multistate

pages 5 through 7 before completing this section.

Total

Total

Ratio within

Partnerships

within

everywhere

Arizona

Only)

Arizona

(a) / (b)

C1 Average yearly value of real and tangible personal property:

(a) Inventory .................................................................................................

(b) Depreciable assets - at original cost .......................................................

(c) Land ........................................................................................................

(d) Other - describe ......................................................................................

(e) Less construction in progress .................................................................

(f) Less nonbusiness property .....................................................................

(g) Net annual rent paid for leased property, multiplied by 8 ........................

(h) Total real and tangible personal property used .......................................

C2 Wages, salaries, commissions and other compensation of employees

as shown per federal Form 1065 or payroll reports .....................................

C3 (a) Gross sales, less returns and allowances ..............................................

(b) Sales delivered or shipped to Arizona purchasers .................................

(c) Other gross receipts (rents, royalties, interest, etc.) ...............................

(d) Total sales within Arizona .......................................................................

X 2

(e) Double weight sales factor ......................................................................

(f ) Sales factor ratio. For column (a), multiply line C3(d) by

line C3(e); for column (b), add lines C3(a) and C3(c) .............................

Total ratio - add lines C1(h), C2 and C3(f), in column (c) ............................

C4

Average ratio - divide line C4, column (c) by four (4). Enter the result

C5

here and on the Arizona Schedule K-1(NR) in column 2 .............................

ADOR 06-0031 (98)

1

1 2

2