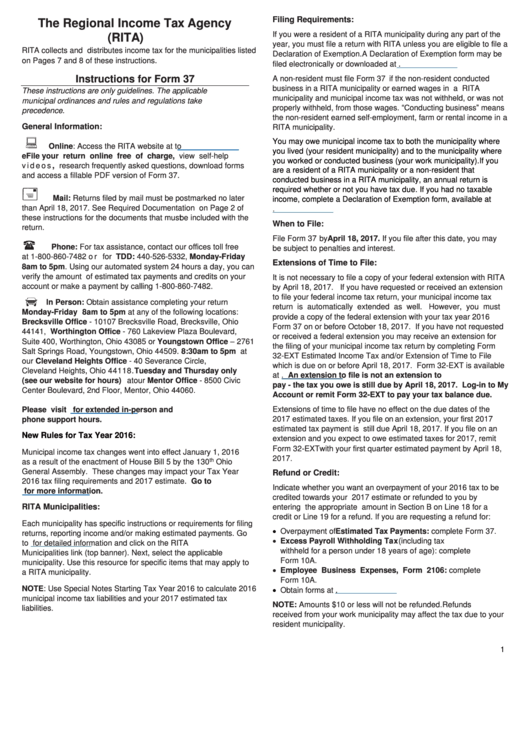

Instructions For Form 37 - The Regional Income Tax Agency (Rita)

ADVERTISEMENT

Filing Requirements:

The Regional Income Tax Agency

If you were a resident of a RITA municipality during any part of the

(RITA)

year, you must file a return with RITA unless you are eligible to file a

RITA collects and distributes income tax for the municipalities listed

Declaration of Exemption. A Declaration of Exemption form may be

on Pages 7 and 8 of these instructions.

filed electronically or downloaded at

Instructions for Form 37

A non-resident must file Form 37 if the non-resident conducted

business in a RITA municipality or earned wages in a RITA

These instructions

are

only

guidelines.

The

applicable

municipality and municipal income tax was not withheld, or was not

municipal

ordinances

and rules

and

regulations

take

properly withheld, from those wages. “Conducting business” means

precedence.

the non-resident earned self-employment, farm or rental income in a

General Information:

RITA municipality.

You may owe municipal income tax to both the municipality where

Online: Access the RITA website at

to

you lived (your resident municipality) and to the municipality where

eFile your return online free of charge, v i e w s e l f - h e l p

you worked or conducted business (your work municipality). If you

v i d e o s , research frequently asked questions, download forms

are a resident of a RITA municipality or a non-resident that

and access a fillable PDF version of Form 37.

conducted business in a RITA municipality, an annual return is

required whether or not you have tax due. If you had no taxable

Mail: Returns filed by mail must be postmarked no later

income, complete a Declaration of Exemption form, available at

than April 18, 2017. See Required Documentation on Page 2 of

these instructions for the documents that must be included with the

When to File:

return.

File Form 37 by April 18, 2017. If you file after this date, you may

Phone: For tax assistance, contact our offices toll free

be subject to penalties and interest.

at 1 -800-860-7482 o r f o r TDD: 440-526-5332, Monday-Friday

Extensions of Time to File:

8am to 5pm. Using our automated system 24 hours a day, you can

verify the amount of estimated tax payments and credits on your

It is not necessary to file a copy of your federal extension with RITA

account or make a payment by calling 1-800-860-7482.

by April 18, 2017. If you have requested or received an extension

to file your federal income tax return, your municipal income tax

In Person: Obtain assistance completing your return

return is automatically extended as well.

However, you must

Monday-Friday 8am to 5pm at any of the following locations:

provide a copy of the federal extension with your tax year 2016

Brecksville Office - 10107 Brecksville Road, Brecksville, Ohio

Form 37 on or before October 18, 2017. If you have not requested

44141, Worthington Office - 760 Lakeview Plaza Boulevard,

or received a federal extension you may receive an extension for

Suite 400, Worthington, Ohio 43085 or Youngstown Office – 2761

the filing of your municipal income tax return by completing Form

Salt Springs Road, Youngstown, Ohio 44509. 8:30am to 5pm at

32-EXT Estimated Income Tax and/or Extension of Time to File

our Cleveland Heights Office - 40 Severance

Circle,

which is due on or before April 18, 2017. Form 32-EXT is available

Cleveland Heights, Ohio 44118. Tuesday and Thursday only

at An extension to file is not an extension to

(see our website for hours) at our Mentor Office - 8500 Civic

pay - the tax you owe is still due by April 18, 2017. Log-in to My

Center Boulevard, 2nd Floor, Mentor, Ohio 44060.

Account or remit Form 32-EXT to pay your tax balance due.

Extensions of time to file have no effect on the due dates of the

Please visit

for extended in-person and

2017 estimated taxes. If you file on an extension, your first 2017

phone support hours.

estimated tax payment is still due April 18, 2017. If you file on an

New Rules for Tax Year 2016:

extension and you expect to owe estimated taxes for 2017, remit

Form 32-EXTwith your first quarter estimated payment by April 18,

Municipal income tax changes went into effect January 1, 2016

2017.

th

as a result of the enactment of House Bill 5 by the 130

Ohio

General Assembly. These changes may impact your Tax Year

Refund or Credit:

2016 tax filing requirements and 2017 estimate.

Go to

Indicate whether you want an overpayment of your 2016 tax to be

for more information.

credited towards your 2017 estimate or refunded to you by

RITA Municipalities:

entering the appropriate amount in Section B on Line 18 for a

credit or Line 19 for a refund. If you are requesting a refund for:

Each municipality has specific instructions or requirements for filing

Overpayment of Estimated Tax Payments: complete Form 37.

returns, reporting income and/or making estimated payments. Go

Excess

Payroll

Withholding

Tax

(including

tax

to

for detailed information and click on the RITA

withheld for a person under 18 years of age): complete

Municipalities link (top banner). Next, select the applicable

Form 10A.

municipality. Use this resource for specific items that may apply to

Emplo yee Business Expenses, Form 2106: complete

a RITA municipality.

Form 10A.

NOTE: Use Special Notes Starting Tax Year 2016 to calculate 2016

Obtain forms at

municipal income tax liabilities and your 2017 estimated tax

NOTE: Amounts $10 or less will not be refunded. Refunds

liabilities.

received from your work municipality may affect the tax due to your

resident municipality.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8