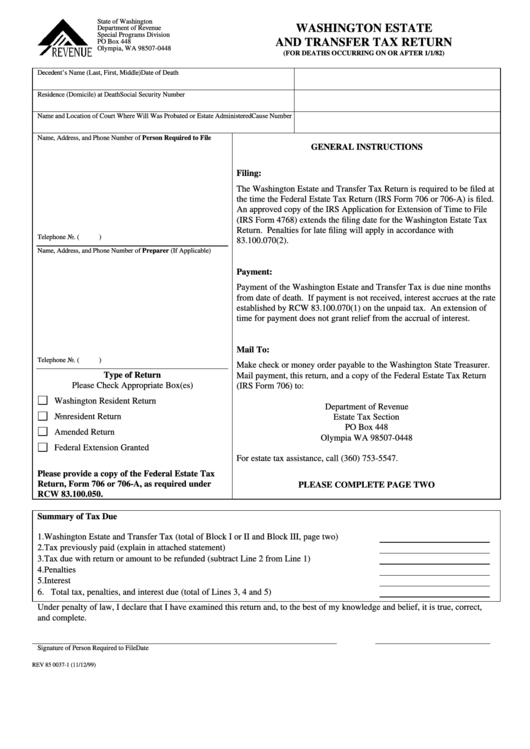

Form Rev 85 0037-1 - Washington Estate And Transfer Tax Return - 1999

ADVERTISEMENT

State of Washington

WASHINGTON ESTATE

Department of Revenue

Special Programs Division

AND TRANSFER TAX RETURN

PO Box 448

Olympia, WA 98507-0448

(FOR DEATHS OCCURRING ON OR AFTER 1/1/82)

Decedent’s Name (Last, First, Middle)

Date of Death

Residence (Domicile) at Death

Social Security Number

Name and Location of Court Where Will Was Probated or Estate Administered

Cause Number

Name, Address, and Phone Number of Person Required to File

GENERAL INSTRUCTIONS

Filing:

The Washington Estate and Transfer Tax Return is required to be filed at

the time the Federal Estate Tax Return (IRS Form 706 or 706-A) is filed.

An approved copy of the IRS Application for Extension of Time to File

(IRS Form 4768) extends the filing date for the Washington Estate Tax

Return. Penalties for late filing will apply in accordance with

Telephone No. (

)

83.100.070(2).

Name, Address, and Phone Number of Preparer (If Applicable)

Payment:

Payment of the Washington Estate and Transfer Tax is due nine months

from date of death. If payment is not received, interest accrues at the rate

established by RCW 83.100.070(1) on the unpaid tax. An extension of

time for payment does not grant relief from the accrual of interest.

Mail To:

Telephone No. (

)

Make check or money order payable to the Washington State Treasurer.

Type of Return

Mail payment, this return, and a copy of the Federal Estate Tax Return

Please Check Appropriate Box(es)

(IRS Form 706) to:

Washington Resident Return

Department of Revenue

Nonresident Return

Estate Tax Section

PO Box 448

Amended Return

Olympia WA 98507-0448

Federal Extension Granted

For estate tax assistance, call (360) 753-5547.

Please provide a copy of the Federal Estate Tax

Return, Form 706 or 706-A, as required under

PLEASE COMPLETE PAGE TWO

RCW 83.100.050.

Summary of Tax Due

1. Washington Estate and Transfer Tax (total of Block I or II and Block III, page two)

2. Tax previously paid (explain in attached statement)

3. Tax due with return or amount to be refunded (subtract Line 2 from Line 1)

4. Penalties

5. Interest

6. Total tax, penalties, and interest due (total of Lines 3, 4 and 5)

Under penalty of law, I declare that I have examined this return and, to the best of my knowledge and belief, it is true, correct,

and complete.

Signature of Person Required to File

Date

REV 85 0037-1 (11/12/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2