Instruction For Atf Form 5630.5 - Special Tax Registration And Return Alcohol And Tobacco Page 2

ADVERTISEMENT

TAXPAYER REMINDER

This is an annual tax due before starting business

and by July 1 each

year after that. After your initial payment of this tax, you should receive

a “renewal” registration

and return each year in the mail, prior tothe due

date. However,

if you do not receive a renewal form, you are still liable

for the tax and should

contact

the nearest

ATF office

noted in the

instructions

to obtain a Special (Occupational)

Tax Registration

and

Return.

Your canceled check may be used as evidence of tax payment until you

receive your Special Tax Stamp from ATF.

*U.S. sPo:19s7-418-all/s#2s

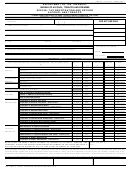

ATF F 5630.5

(4-96)

... —--

...—. -.—_ . .. -. . _

. . .

..-— —

.—.- .-.

.

...—

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2