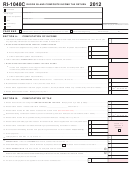

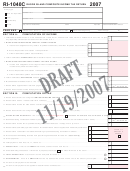

Form Ri-1040c - Rhode Island Composite Income Tax Return - 2007 Page 2

ADVERTISEMENT

2007

SECTION C:

APPORTIONMENT

column A

column B

Rhode Island

everywhere

AVERAGE NET BOOK VALUE

27.

Inventory.....................................................................................................................

27A.

A.

27B.

B.

Depreciable assets....................................................................................................

C.

27C.

Land...........................................................................................................................

D.

Rent (8 times annual net rental rate).........................................................................

27D.

E.

27E.

Total - Add lines 27A, 27B, 27C and 27D..................................................................

_ . _ _ _ _

F.

Ratio in Rhode Island, line 27E, Column A divided by line 27E, Column

B.....Calculate to four (4) decimal

places.....................

27F.

RECEIPTS

{

Rhode Island Sales.........................................

A.

28.

Gross receipts.......................................

28A.

Sales Under 44-11-14(a)(2)(i)(B)....................

B.

28B.

Dividends...................................................................................................................

C.

28C.

Interest.......................................................................................................................

D.

28D.

Rents..........................................................................................................................

E.

28E.

Royalties....................................................................................................................

F.

Net capital gains........................................................................................................

28F.

G.

28G.

Ordinary income.........................................................................................................

H.

28H.

Other income.............................................................................................................

I.

28I.

Income exempt from federal taxation........................................................................

J.

28J.

Total - Add lines 28A, 28B, 28C, 28D, 28E, 28F, 28G, 28H and 28I.........................

_ . _ _ _ _

K.

Ratio in Rhode Island, line 28J, column A divided by line 28J, column

B.....Calculate to four (4) decimal

places........................

28K.

SALARIES

29.

Salaries and wages paid or incurred.........................................................................

29A.

A.

_ . _ _ _ _

B.

Ratio in Rhode Island, line 29A, column A divided by line 29A, column

B.....Calculate to four (4) decimal

places......................

29B.

RATIO

_ . _ _ _ _

30.

Total of Rhode Island ratios shown on lines 27F, 28K and 29B............................................................................................................

30.

_ . _ _ _ _

31.

Apportionment Ratio - line 30 divided by the number 3 or the number of ratios used - enter here and on page 1, Section A, line 7.

31.

SECTION D: QUALIFIED ELECTING MEMBER INFORMATION

RI

RI

SOCIAL

NAME

ADDRESS

SECURITY NUMBER

SOURCE INCOME

INCOME TAX

Attach additional schedules, if more space is required.

Under penalties of perjury, I declare that I have examined this return, and to the best of my knowledge and belief, it is true, correct and complete.

Title

Signature

Date

Sign Here

May the division contact your preparer about this return?

Yes

No

Signature of preparer

SSN, PTIN or EIN

Telephone number

(

)

Sign Here

Mail returns to: RI Division of Taxation - One Capitol Hill - Providence, RI 02908-5806

page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11