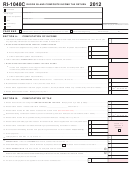

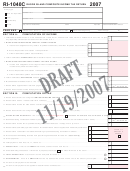

Form Ri-1040c - Rhode Island Composite Income Tax Return - 2007 Page 3

ADVERTISEMENT

2007 INSTRUCTIONS FOR FILING RI-1040C

For more information on filing a Composite Return or to obtain forms,

refer to Rhode Island Division of Taxation’s website : or call (401) 574-8970

GENERAL INFORMATION

Due to the passage of a bill disallowing

depreciation will remain limited to $25,000

federal bonus depreciation for Rhode

for Rhode Island purposes. Therefore, in

Island purposes, any bonus depreciation

the first year any additional section 1 7 9

Form RI-1040C is used to report the Rhode

taken for federal purposes must be added

depreciation taken for federal purposes

Island source income of qualified electing

back as a modification to income.

should have been added back as a modifi-

nonresident members of LLCs, Sub S

cation to income. Accordingly, in subse-

Corporations, Partnerships, and Trusts.

Due to the passage of a bill disallowing

quent years, if federal depreciation is less

the increase in the section 179 depreciation

than what previously would have been

If a pass-through entity is doing business in

under the Jobs and Growth Tax Relief

allowed, the difference can be deducted as

Rhode Island, or has income, gain, loss, or

Reconciliation Act of 2003, section 179

a modification to income.

deduction derived from or connected with

depreciation will remain limited to $25,000

sources within Rhode Island, it can file a

for Rhode Island purposes. Therefore, any

A separate schedule of depreciation

composite return on behalf of those quali-

additional section 179 depreciation taken

must be kept for Rhode Island purposes.

fied electing nonresident members. All of

for federal purposes must be added back

The gain or loss on the sale or other dispo-

the qualified electing nonresident members

as a modification to income.

sition of the asset is to be determined, for

must have the same taxable year.

Rhode Island purposes, using the Rhode

A separate schedule of depreciation

Island depreciation schedule.

In order to be included in the composite fil-

must be kept for Rhode Island purposes.

ing, the nonresident member must com-

The gain or loss on the sale or other dispo-

For further information regarding

plete a Form RI 1040C-NE and file it with

sition of the asset is to be determined, for

bonus depreciation or section 179 depreci-

the entity from which they are receiving the

Rhode Island purposes, using the Rhode

ation refer to the General Instructions of

Rhode Island source income. The entity

Island depreciation schedule.

Form

RI-1040NR,

Rhode

Island

must keep all of these election forms on file

Nonresident Income Tax return.

and be able to furnish them to the Rhode

For further information regarding

Island Division of Taxation upon request.

bonus depreciation or section 179 depreci-

Line 4C - Enter any other modifications

ation refer to the General Instructions of

decreasing Federal Taxable Income and

DUE DATE: RI-1040C is due on the fif-

Form RI-1040NR, Rhode Island Nonresi-

provide an explanation for the modification.

teenth day of the fourth month following the

dent Income Tax return.

close of the taxable year of the qualified

Line 5 - Total Modifications Decreasing

electing nonresident members. (April 15,

Line 2C - Enter any other modifications

Federal Taxable Income - add lines 4A, 4B

2008 for calendar year taxpayers).

increasing Federal Taxable Income and

and 4C.

provide an explanation for the modification.

Send return to:

Line 6 - Modified Federal Taxable Income-

R.I. Division of Taxation

Line 3 - Total Modifications Increasing

Add line 1 to line 3 and then subtract line

One Capitol Hill

Federal Taxable Income - add lines 2A, 2B

5. (Line 1 + line 3 - line 5)

Providence, RI 02908-5806

and 2C.

Line 7 - Rhode Island apportionment ratio:

SPECIFIC INSTRUCTIONS

Line 4 - Modifications Decreasing

If the entity operates solely in Rhode

Federal Taxable Income

Island, enter 1.0000. If it is a multistate

Please complete the top of the return by fill-

entity, enter computed ratio from line 30 of

ing in the name, address and federal iden-

Line 4A - Enter any income from obliga-

apportionment worksheet located on page

tification number. Also, please check off

tions of the United State Government to the

2, Section C.

(Calculate ratio to four

the entity’s year end. If not a calendar year

extent that it is included in income for fed-

decimal places.)

end, please indicate the beginning and end

eral tax purposes but exempt for state pur-

dates of the entity’s fiscal year.

poses.

Line 8 - Rhode Island Source Income -

multiply your Modified Federal Taxable

SECTION A: COMPUTATION OF INCOME

Line 4B - Enter Bonus Depreciation and

Income (line 6) by the apportionment ratio

Line 1 - Enter your total Federal Taxable

Section 179 Depreciation that has not been

(line 7).

Income from Federal Form 1120S, line 21;

taken for federal purposes because the

Federal Form 1065, line 22 or Federal

depreciation was not taken originally.

SECTION B: COMPUTATION OF TAX

Form 1041, line 18, and add to that any

separately stated income or deductions list-

Since a bill was passed disallowing

For the 2007 tax year, composite filers

ed on your K-1.

federal bonus depreciation for Rhode

have the option of using a new flat tax

Island purposes, in the first year any bonus

rate of 7.5%. Complete lines 9 through

Line 2 - Modifications Increasing

12 to determine which option is best for

depreciation taken for federal purposes

Federal Taxable Income

the entity.

should have been added back as a modifi-

cation to income. Therefore, in subsequent

Line 2A - Enter any income from obliga-

Line 9 - Calculate the Rhode Island

years, if federal depreciation is less than

tions of any state or its political subdivi-

income tax using the Rhode Island

what previously would have been allowed,

sions, other than Rhode Island.

the difference can be deducted as a modifi-

Composite Income Tax rate of 9.9%.

cation to income.

Line 2B - Enter Bonus Depreciation and

Line 10 - Enter any Rhode Island credit

the increased Section 179 Depreciation

amounts, indicate the credit form num-

Since a bill was passed disallowing the

that must be added back to Rhode Island

ber(s) and attach the credit form(s) and

increase in the section 179 depreciation

income.

supporting documentation to the 1040C.

under the Jobs and Growth Tax Relief

Reconciliation Act of 2003, section 179

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11