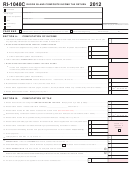

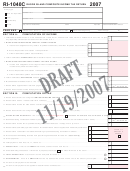

Form Ri-1040c - Rhode Island Composite Income Tax Return - 2007 Page 7

ADVERTISEMENT

RI-4868

Rhode Island Application for Automatic Extension of Time To

2007

File a Rhode Island Composite Tax Return

You can use Form RI-4868C to obtain an automatic 6 month exten-

ADDITIONAL INFORMATION

sion of time to file your Rhode Island Composite Tax Return.

The filing or granting of an extension of time to file does not extend

the time for payment of tax due on the return.

GENERAL INSTRUCTIONS

Use Form RI-4868C to apply for 6 more months to file Form

HOW TO PREPARE YOUR PAYMENT?

RI-1040C, Rhode Island Composite Tax Return.

Make your check or money order payable to the "R.I. Division of

Taxation." Do not send cash. Make sure the entity’s name and

EXTENSION OF TIME

address appear on your check or money order. Write "Form RI-

4868C", your daytime phone number and the entity’s federal identi-

The Rhode Island extension form need not be filed if you are not

fication number on your check or money order.

required to make payment with Rhode Island extension form.

If you must file a Rhode Island request for extension, you should:

PAYMENT BY CREDIT CARD

1. Prepare the Rhode Island Extension Form RI-4868C.

2. Clearly show the full amount properly estimated as Rhode

Island tax for the year 2007.

3. File the extension with the Rhode Island Division of Taxation

on or before the due date for filing the Rhode Island Composite

Tax Return.

The extension must be filed by the 15th day of the fourth month

following the close of the entity’s taxable year (April 15, 2008

for a calendar year entity).

Contact the service provider listed on this page and follow their

4. Pay the amount of Rhode Island tax due as calculated on Form

instructions. Enter on page 1 of Form RI-1040C, in the upper left

RI-4868C.

corner, the confirmation number you were given at the end of the

5. Be sure to attach a copy of the Form RI-4868C to the front of

transaction and the amount of your tax payment (not including the

the Rhode Island return when it is filed.

convenience fee).

6. Retain the top portion of this form for your records. Detach and

return the lower portion with your payment.

Telephone: 1-800-2PAY-TAX (1-800-272-9829)

Internet:

Date Paid

Check Number

Amount

$

DETACH HERE AND MAIL WITH YOUR PAYMENT

RI-4868C

2007

RHODE ISLAND APPLICATION FOR AUTOMATIC 6 MONTH EXTENSION

OF TIME TO FILE RHODE ISLAND COMPOSITE TAX RETURN

NAME

Enter tentative tax computation

A.

Tentative RI income tax

ADDRESS

Total payments

B.

CITY, STATE & ZIP CODE

RI-4868C

C.

BALANCE DUE

(line A less line B)

FEDERAL IDENTIFICATION NUMBER

ENTER

$

0 0

AMOUNT

ENCLOSED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11