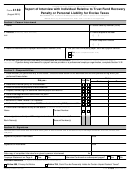

Arizona Form 74 - Report Of Personal Representative Of Decedent - Arizona Department Of Revenue

ADVERTISEMENT

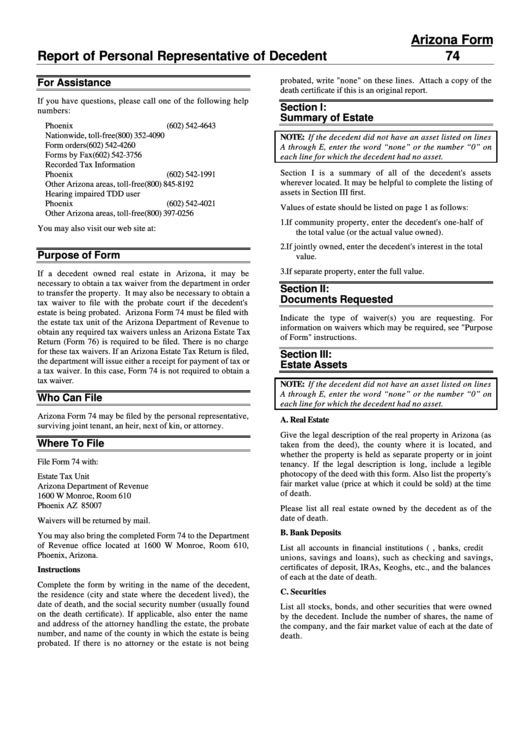

Arizona Form

Report of Personal Representative of Decedent

74

probated, write "none" on these lines. Attach a copy of the

For Assistance

death certificate if this is an original report.

If you have questions, please call one of the following help

Section I:

numbers:

Summary of Estate

Phoenix

(602) 542-4643

Nationwide, toll-free

(800) 352-4090

NOTE: If the decedent did not have an asset listed on lines

Form orders

(602) 542-4260

A through E, enter the word “none” or the number “0” on

Forms by Fax

(602) 542-3756

each line for which the decedent had no asset.

Recorded Tax Information

Section I is a summary of all of the decedent's assets

Phoenix

(602) 542-1991

wherever located. It may be helpful to complete the listing of

Other Arizona areas, toll-free

(800) 845-8192

assets in Section III first.

Hearing impaired TDD user

Phoenix

(602) 542-4021

Values of estate should be listed on page 1 as follows:

Other Arizona areas, toll-free

(800) 397-0256

1.

If community property, enter the decedent's one-half of

You may also visit our web site at:

the total value (or the actual value owned).

2.

If jointly owned, enter the decedent's interest in the total

Purpose of Form

value.

3.

If separate property, enter the full value.

If a decedent owned real estate in Arizona, it may be

necessary to obtain a tax waiver from the department in order

Section II:

to transfer the property. It may also be necessary to obtain a

Documents Requested

tax waiver to file with the probate court if the decedent's

estate is being probated. Arizona Form 74 must be filed with

Indicate the type of waiver(s) you are requesting. For

the estate tax unit of the Arizona Department of Revenue to

information on waivers which may be required, see "Purpose

obtain any required tax waivers unless an Arizona Estate Tax

of Form" instructions.

Return (Form 76) is required to be filed. There is no charge

for these tax waivers. If an Arizona Estate Tax Return is filed,

Section III:

the department will issue either a receipt for payment of tax or

Estate Assets

a tax waiver. In this case, Form 74 is not required to obtain a

tax waiver.

NOTE: If the decedent did not have an asset listed on lines

A through E, enter the word “none” or the number “0” on

Who Can File

each line for which the decedent had no asset.

Arizona Form 74 may be filed by the personal representative,

A. Real Estate

surviving joint tenant, an heir, next of kin, or attorney.

Give the legal description of the real property in Arizona (as

Where To File

taken from the deed), the county where it is located, and

whether the property is held as separate property or in joint

File Form 74 with:

tenancy. If the legal description is long, include a legible

photocopy of the deed with this form. Also list the property's

Estate Tax Unit

fair market value (price at which it could be sold) at the time

Arizona Department of Revenue

of death.

1600 W Monroe, Room 610

Phoenix AZ 85007

Please list all real estate owned by the decedent as of the

date of death.

Waivers will be returned by mail.

B. Bank Deposits

You may also bring the completed Form 74 to the Department

of Revenue office located at 1600 W Monroe, Room 610,

List all accounts in financial institutions (i.e., banks, credit

Phoenix, Arizona.

unions, savings and loans), such as checking and savings,

certificates of deposit, IRAs, Keoghs, etc., and the balances

Instructions

of each at the date of death.

Complete the form by writing in the name of the decedent,

C. Securities

the residence (city and state where the decedent lived), the

date of death, and the social security number (usually found

List all stocks, bonds, and other securities that were owned

on the death certificate). If applicable, also enter the name

by the decedent. Include the number of shares, the name of

and address of the attorney handling the estate, the probate

the company, and the fair market value of each at the date of

number, and name of the county in which the estate is being

death.

probated. If there is no attorney or the estate is not being

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2