How To Complete Your Periodic Rental Motor Vehicle And Tour Vehicle Surcharge Tax Return (Form Rv-2) Page 3

ADVERTISEMENT

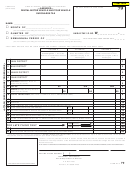

Example: In Column B, Line 1, BTK has entered “2” for the number of tour vans for Oahu. BTK does not have any tour

vans on the other islands.

STEP 6 - Column C, lines 1 through 4. Enter the number of buses (26 or more passengers) used during the period for

each district. If filing quarterly or semiannually, multiply the number of buses by the number of months in the period.

Example: In Column C, Line 1, BTK has entered “1” for the number of tour buses for Oahu. BTK does not have any

buses on the other islands.

STEP 7a. - Add the number of Rental Motor Vehicle Days from Column A for all districts (Lines 1 through 4).

Example: In Column A, Line 5, BTK has entered 795 rental vehicle days for the month of January.

STEP 7b. - Add the number of vans from Column B for all districts (Lines 1 through 4).

Example: In Column B, Line 5, BTK has entered 2 vans for the month of January.

STEP 7c. - Add the number of buses from Column C for all districts (Lines 1 through 4).

Example: In Column C, Line 5, BTK has entered 1 bus for the month of January.

STEP 8a - In Column A, multiply the number entered on Line 5 by the tax rate of $3 (Line 6), and enter the result on Line 7.

Example: BTK has multiplied 795 (the number of vehicle days entered on Line 5) by $3 (the tax rate listed on Line 6) to get

$2,385, which is entered in Column A, Line 7 (795 x $3 = $2,385).

STEP 8b - In Column B, multiply the number entered on Line 5 by the tax rate of $15 (Line 6) and enter the result on

Column B, Line 7.

Example: BTK has multiplied 2 (the number of vans in use during the month on Line 5) by $15 (the tax rate listed on Line

6) to get $30, which is entered in Column B, Line 7 (2 x $15 = $30).

STEP 8c - In Column C, multiply the number entered on Line 5 by the tax rate of $65 (Line 6), and enter the result on Line 7.

Example: BTK has multiplied 1 (the number of buses in use during the month on Line 5) by $65 (the tax rate on Line 6) to

get $65, which is entered in Column C, Line 7 (1 x $65 = $65).

COLUMN A

COLUMN B

COLUMN C

Rental Motor Vehicle

Tour Vehicle Surcharge Tax —

Tour Vehicle Surcharge Tax —

4

6

5

Surcharge Tax — Enter the

Enter the Number of Tour

Enter the Number of Tour

Number of Rental Motor Vehicle

Vehicles Carrying 8 - 25

Vehicles Carrying 26 or More

Days

Passengers

Passengers

525

2

1

1 OAHU DISTRICT

1

270

2 MAUI DISTRICT

2

3 HAWAII DISTRICT

3

4 KAUAI DISTRICT

4

7a

5 TOTALS

7b

7c

795

2

1

(Add lines 1 thru 4 of

5

columns A, B, and C)

$3

$15

$65

6 RATES

6

TAXES

(Multiply line 5 by line 6 of

8c

8a

8b

2,385

30

65

7

00

00

00

7

columns A, B, and C)

TOTAL TAXES DUE (Add line 7,

IF YOU DO NOT HAVE ANY ACTIVITY AND THE RESULT IS NO TAX LIABILITY ENTER “0”

8

9

fig 2.1

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4