How To Complete Your Periodic Rental Motor Vehicle And Tour Vehicle Surcharge Tax Return (Form Rv-2) Page 4

ADVERTISEMENT

FINISHING THE TAX RETURN

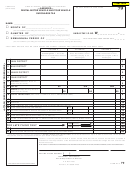

(fig. 2.2)

STEP 9 - Add Columns A through C of Line 7, and enter the total on Line 8. This is the total tax due. CAUTION: LINE 8

MUST BE FILLED IN. If you do not have any rental motor vehicle or tour vehicle activity and therefore have no tax due,

enter a zero (0) on Line 8.

Example: BTK has added $ 2,385, $ 30, and $ 65 for a total of $ 2,480 which is entered on Line 8.

STEP 10 - If you file a tax return after the due date and there is tax due on the return, then you must compute penalty and

interest charges. The penalty is assessed at the rate of 5% a month, or part of a month, from the due date to the filing

date, to a maximum of 25%. Interest is assessed at the rate of 2/3 of 1% a month, or part of a month, on the unpaid tax

and penalty. Instructions for computing the penalty and interest may be requested from any district tax office. After

computing the amounts, enter the penalty on Line 9a and the interest on Line 9b.

If you are unable to compute the penalty and interest, the Department will compute it for you and send you a statement.

STEP 11 - Add the amounts on Lines 8, 9a, and 9b, and enter the sum on Line 10. This is the amount of your total

payment due, including any penalty and interest. If you are not making a payment, enter a zero (0).

STEP 12 - Sign your tax return. The sole proprietor, a partner, corporate officer, or an authorized agent must sign and

date the tax return, state his/her title, and write the date the return is signed.

8c

8a

8b

2,385

30

65

7

00

00

00

7

columns A, B, and C)

TOTAL TAXES DUE (Add line 7,

IF YOU DO NOT HAVE ANY ACTIVITY, AND THE RESULT IS NO TAX LIABILITY, ENTER “0”

8

9

2,480 00

8

ON LINE 8. THIS RETURN MUST BE FILED.

columns A thru C, and enter here)

9a

9a

PENALTY

FOR LATE FILING ONLY

10

9b

9b

INTEREST

Make check payable to “HAWAII STATE TAX COLLECTOR” in U.S.

11

PLEASE ENTER AMOUNT OF

dollars drawn on any U.S. bank. Write your rental motor vehicle and

10

10

YOUR PAYMENT

2,480 00

tour vehicle registration number and the period of payment on the

(add lines 8, 9a and 9b )

check.

I declare, under the penalties set forth in section 231-36, HRS, that this is a true and correct return, prepared in

accordance with the provisions of the Rental Motor Vehicle and Tour Vehicle Surcharge Tax Law and the rules issued

thereunder.

IN THE CASE OF A CORPORATION OR PARTNERSHIP, THIS RETURN MUST BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY AUTHORIZED AGENT.

12

owner

Betty T. Kealoha

2/27/00

SIGNATURE

TITLE

DATE

MAILING ADDRESSES:

THIS SPACE FOR DATE RECEIVED STAMP

Oahu District Office

Maui District Office

P.O. Box 2430

P.O. Box 1427

Honolulu, HI 96804-2430

Wailuku, HI 96793-6427

Kauai District Office

Hawaii District Office

P.O. Box 1687

P.O. Box 937

Lihue, HI 96766-5687

Hilo, HI 96721-0937

70

FORM RV-2

fig 2.2

SENDING IN THE TAX RETURN AND PAYMENT

Attach a check made payable to the “HAWAII STATE TAX COLLECTOR” in U.S. dollars to the tax return. Write “RV,”

the filing period, and your R.V. registration number on the check so that it may be properly credited to your account. DO

NOT SEND CASH.

Send both the tax return and check to your respective district tax office. The addresses are on Form RV-2. If you prefer,

you may drop off your tax return and payment at any district tax office.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4