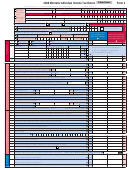

Column A (for single,

Column B (for spouse

Form 2, Page 2 – 2005

Social Security Number:___________________________

joint, separate, or head

when filing separately

of household)

using filing status 3a)

Enter here Montana adjusted gross income from line 40. .........................................

41

41

41

Deductions

Check only one

42

(A) Standard Deduction:

(A)

(B) Itemized Deductions (from Form 2A, Schedule III, line 30): (B)

42

42

Subtract line 42 from line 41 and enter amount here. ...............................................

43

43

43

Exemptions (all individuals are entitled to at least one exemption)

Multiply $1,900 by the number of exemptions on line 6d and enter result here. .......

44

44

44

45

Subtract line 44 from line 43. Enter result here, but not less than zero. This is

your taxable income. ..............................................................................................

45

45

Enter tax from the tax table on page 9. If line 45 is less than zero, enter zero. ........

46

46

46

Enter your 1% capital gains tax credit here. ..............................................................

47

47

47

48

Subtract line 47 from 46 and enter result here, but not less than zero. This is your

resident tax after capital gains tax credit. ............................................................

48

48

48a

Non-resident, part-year resident tax after capital gains tax credit. Enter here

the amount from Form 2A, Schedule IV, line 20, but not less than zero. ..................

48a

48a

Enter nonrefundable single-year credits from Form 2A, Schedule V, line 13. ...........

49

49

49

Enter nonrefundable carryover credits from Form 2A, Schedule V, line 26. .............

50

50

50

51

Add lines 49 and 50 and subtract this total from line 48 or 48a and enter result

here, but not less than zero. This is your total tax after nonrefundable credits...

51

51

Enter family education savings account recapture tax. .............................................

52

52

52

Enter endowment credit recapture tax. .....................................................................

53

53

53

54

Enter rural physician’s credit recapture tax. ..............................................................

54

54

Add lines 52 through 54 and enter result here. This is your total recapture tax. ..

55

55

55

Add lines 51 and 55 and enter result here. This is your total tax due. ..................

56

56

56

Combine amounts on line 56 columns A and B and enter result here. This is your combined total tax due.

57

57

Enter Montana income tax withheld. Attach federal Form(s) W-2 and 1099. ...........

58

58

58

Enter estimated tax payments here. .........................................................................

59

59

59

Enter extension payment here. .................................................................................

60

60

60

61

Enter refundable credits from Form 2A, Schedule V, line 30. ...................................

61

61

Add lines 58 through 61 and enter here. These are your total payments/offsets.

62

62

62

Combine amounts on line 62 columns A and B. These are your combined payments and offsets. .............

63

63

64

Interest on underpayment

Late file penalty

Late pay penalty

Interest

Enter the sum of 64a

.........

thru 64d here.

64

64

64a)

64b)

64c)

64d)

65

Enter other penalties here. ..........................................................................................................................

65

65

66

Check-off

Nongame wildlife program

Child abuse prevention

Agriculture in schools

Contribution

66

66a)

66b)

66c)

Total .......... 66

67 Add lines 57, 64, 65, and 66 and enter result here.

This is the sum of your total tax, penalties, interest and

contributions.

............................................................................................................................................................... 67

67

68

If line 67 is more than line 63, enter the difference here. This is the amount you owe. Make check payable to MONTANA

.............

68

DEPARTMENT OF REVENUE or visit our website at to pay by credit card or E-check.

68

69

If line 67 is less than line 63, enter the difference here. ..............................................................................

69

69

Enter the amount of line 69 you want applied to your 2006 estimated tax. .................................................

70

70

70

71

Subtract lines 70 from line 69 and enter result here. This is your refund. ................................................

71

71

If you wish to use direct deposit enter your RTN# and ACCT # below. See instructions.

checking

RTN#

ACCT#

savings

If applicable, check appropriate box.

Name, address and telephone number of paid preparer.

Extension – Check this box and

rd

2/3

farming gross income

attach a copy of your federal

Form 4868 to receive your

Annualized estimated payments

Montana extension.

SSN or FEIN:

Do not mail 2006 forms and instructions

Yes

No

May the DOR discuss this return with your tax preparer?

Questions? Call (406) 444-6900 or TDD (406) 444-2830 for hearing impaired

X

X

Your signature is required

Date

Daytime telephone number

Spouse’s signature

Date

I declare under penalty of false swearing that the information in this return and attachments is true, correct and complete.

1

1 2

2