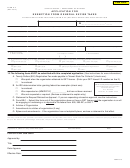

Form Ca-6 - Application For Abatement - 1999 Page 2

ADVERTISEMENT

Filing Information

Prerequisites to filing an application for abatement

Two requirements must be met in order for an application for abatement to be valid. First, the required return must have been filed for the period stated

on the application. Second, the application must be submitted to DOR within one of the following time limits, whichever is later:

a. Within three years from the due date for filing the return (regardless of any extension of time to file);

b. Within two years from the date the tax was assessed or deemed to be assessed;

c. Within one year from the date the tax was paid; or

d. Within 60 days of DOR’s determination of a responsible person’s personal liability.

e. Within any agreed-upon extension of time for assessment of taxes under MGL, Ch. 62C, sec. 27.

Federal change

If, as a result of a change in federal taxable income, a taxpayer believes that a lesser tax was due the Commonwealth than was previously assessed and

the regular abatement time limits have expired, the taxpayer may file an abatement claim within one year from the date of the final federal determination,

including acceptance of an amended federal return by the Internal Revenue Service.

Abatement hearings

You have a statutory right to a hearing to present additional facts and evidence to further support your claim. If you wish to exercise this right, you must

indicate that you request a hearing in the space provided in line 10 on the front of this application.

Taxpayer’s signature

Both the taxpayer and the preparer of this Form CA-6 must sign the form if the preparer does not personally know that the statements contained in this

Form CA-6 are true and correct.

For Departmental Use Only

Issues, facts and determination:

Department conferee

Date

Authorized determination by

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2