Instructions For Form Ftb 5805 - Underpayment Of Estimated Tax By Individuals And Fiduciaries - 1998

ADVERTISEMENT

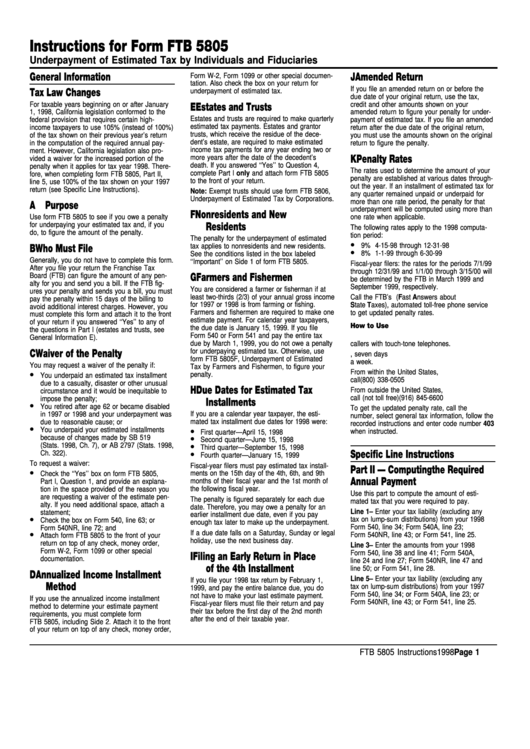

Instructions for Form FTB 5805

Underpayment of Estimated Tax by Individuals and Fiduciaries

General Information

Form W-2, Form 1099 or other special documen-

J Amended Return

tation. Also check the box on your return for

If you file an amended return on or before the

Tax Law Changes

underpayment of estimated tax.

due date of your original return, use the tax,

For taxable years beginning on or after January

credit and other amounts shown on your

E Estates and Trusts

1, 1998, California legislation conformed to the

amended return to figure your penalty for under-

Estates and trusts are required to make quarterly

federal provision that requires certain high-

payment of estimated tax. If you file an amended

estimated tax payments. Estates and grantor

income taxpayers to use 105% (instead of 100%)

return after the due date of the original return,

trusts, which receive the residue of the dece-

of the tax shown on their previous year’s return

you must use the amounts shown on the original

dent’s estate, are required to make estimated

in the computation of the required annual pay-

return to figure the penalty.

income tax payments for any year ending two or

ment. However, California legislation also pro-

more years after the date of the decedent’s

K Penalty Rates

vided a waiver for the increased portion of the

death. If you answered ‘‘Yes’’ to Question 4,

penalty when it applies for tax year 1998. There-

The rates used to determine the amount of your

complete Part I only and attach form FTB 5805

fore, when completing form FTB 5805, Part II,

penalty are established at various dates through-

to the front of your return.

line 5, use 100% of the tax shown on your 1997

out the year. If an installment of estimated tax for

return (see Specific Line Instructions).

Note: Exempt trusts should use form FTB 5806,

any quarter remained unpaid or underpaid for

Underpayment of Estimated Tax by Corporations.

more than one rate period, the penalty for that

A Purpose

underpayment will be computed using more than

F Nonresidents and New

Use form FTB 5805 to see if you owe a penalty

one rate when applicable.

for underpaying your estimated tax and, if you

Residents

The following rates apply to the 1998 computa-

do, to figure the amount of the penalty.

tion period:

The penalty for the underpayment of estimated

•

9% 4-15-98 through 12-31-98

tax applies to nonresidents and new residents.

B Who Must File

•

8% 1-1-99 through 6-30-99

See the conditions listed in the box labeled

Generally, you do not have to complete this form.

‘‘Important’’ on Side 1 of form FTB 5805.

Fiscal-year filers: the rates for the periods 7/1/99

After you file your return the Franchise Tax

through 12/31/99 and 1/1/00 through 3/15/00 will

Board (FTB) can figure the amount of any pen-

G Farmers and Fishermen

be determined by the FTB in March 1999 and

alty for you and send you a bill. If the FTB fig-

September 1999, respectively.

You are considered a farmer or fisherman if at

ures your penalty and sends you a bill, you must

least two-thirds (2/3) of your annual gross income

Call the FTB’s F.A.S.T. (Fast Answers about

pay the penalty within 15 days of the billing to

for 1997 or 1998 is from farming or fishing.

State Taxes), automated toll-free phone service

avoid additional interest charges. However, you

Farmers and fishermen are required to make one

to get updated penalty rates.

must complete this form and attach it to the front

estimate payment. For calendar year taxpayers,

of your return if you answered ‘‘Yes’’ to any of

How to Use F.A.S.T.

the due date is January 15, 1999. If you file

the questions in Part I (estates and trusts, see

Form 540 or Form 541 and pay the entire tax

F.A.S.T. is available in English and Spanish to

General Information E).

due by March 1, 1999, you do not owe a penalty

callers with touch-tone telephones.

for underpaying estimated tax. Otherwise, use

C Waiver of the Penalty

F.A.S.T. is available 24 hours a day, seven days

form FTB 5805F, Underpayment of Estimated

a week.

You may request a waiver of the penalty if:

Tax by Farmers and Fishermen, to figure your

•

From within the United States,

penalty.

You underpaid an estimated tax installment

call. . . . . . . . . . . . . . . .

(800) 338-0505

due to a casualty, disaster or other unusual

H Due Dates for Estimated Tax

From outside the United States,

circumstance and it would be inequitable to

call (not toll free) . . . . . . . .

(916) 845-6600

impose the penalty;

Installments

•

You retired after age 62 or became disabled

To get the updated penalty rate, call the F.A.S.T

in 1997 or 1998 and your underpayment was

If you are a calendar year taxpayer, the esti-

number, select general tax information, follow the

mated tax installment due dates for 1998 were:

due to reasonable cause; or

recorded instructions and enter code number 403

•

•

You underpaid your estimated installments

when instructed.

First quarter

—

April 15, 1998

•

because of changes made by SB 519

Second quarter —

June 15, 1998

•

(Stats. 1998, Ch. 7), or AB 2797 (Stats. 1998,

Third quarter

—

September 15, 1998

•

Specific Line Instructions

Ch. 322).

Fourth quarter

—

January 15, 1999

To request a waiver:

Fiscal-year filers must pay estimated tax install-

Part II — Computing the Required

•

ments on the 15th day of the 4th, 6th, and 9th

Check the ‘‘Yes’’ box on form FTB 5805,

Annual Payment

Part I, Question 1, and provide an explana-

months of their fiscal year and the 1st month of

the following fiscal year.

tion in the space provided of the reason you

Use this part to compute the amount of esti-

are requesting a waiver of the estimate pen-

The penalty is figured separately for each due

mated tax that you were required to pay.

alty. If you need additional space, attach a

date. Therefore, you may owe a penalty for an

Line 1 – Enter your tax liability (excluding any

statement;

earlier installment due date, even if you pay

•

tax on lump-sum distributions) from your 1998

Check the box on Form 540, line 63; or

enough tax later to make up the underpayment.

Form 540, line 34; Form 540A, line 23;

Form 540NR, line 72; and

•

If a due date falls on a Saturday, Sunday or legal

Form 540NR, line 43; or Form 541, line 25.

Attach form FTB 5805 to the front of your

holiday, use the next business day.

return on top of any check, money order,

Line 3 – Enter the amounts from your 1998

Form W-2, Form 1099 or other special

Form 540, line 38 and line 41; Form 540A,

I

Filing an Early Return in Place

documentation.

line 24 and line 27; Form 540NR, line 47 and

of the 4th Installment

line 50; or Form 541, line 28.

D Annualized Income Installment

Line 5 – Enter your tax liability (excluding any

If you file your 1998 tax return by February 1,

Method

tax on lump-sum distributions) from your 1997

1999, and pay the entire balance due, you do

Form 540, line 34; or Form 540A, line 23; or

not have to make your last estimate payment.

If you use the annualized income installment

Form 540NR, line 43; or Form 541, line 25.

Fiscal-year filers must file their return and pay

method to determine your estimate payment

their tax before the first day of the 2nd month

requirements, you must complete form

after the end of their taxable year.

FTB 5805, including Side 2. Attach it to the front

of your return on top of any check, money order,

FTB 5805 Instructions 1998

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3