Instructions For Form Ftb 5806 - Underpayment Of Estimated Tax By Corporations - 1998

ADVERTISEMENT

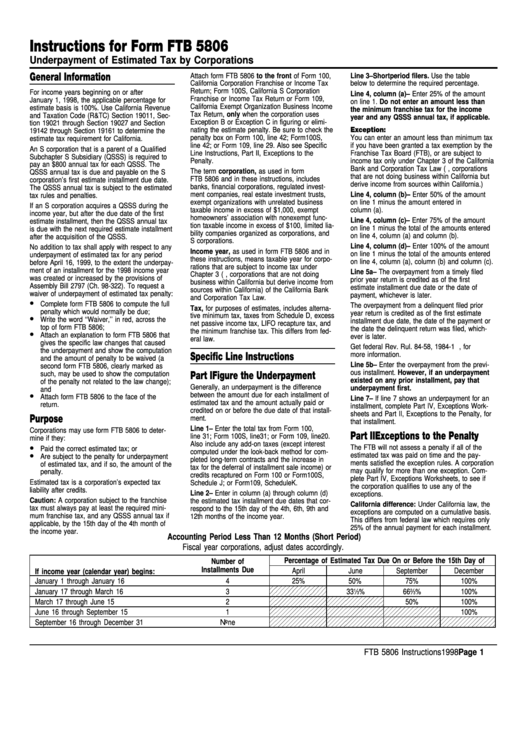

Instructions for Form FTB 5806

Underpayment of Estimated Tax by Corporations

General Information

Attach form FTB 5806 to the front of Form 100,

Line 3 – Short period filers. Use the table

California Corporation Franchise or Income Tax

below to determine the required percentage.

Return; Form 100S, California S Corporation

For income years beginning on or after

Line 4, column (a) – Enter 25% of the amount

Franchise or Income Tax Return or Form 109,

January 1, 1998, the applicable percentage for

on line 1. Do not enter an amount less than

California Exempt Organization Business Income

estimate basis is 100%. Use California Revenue

the minimum franchise tax for the income

Tax Return, only when the corporation uses

and Taxation Code (R&TC) Section 19011, Sec-

year and any QSSS annual tax, if applicable.

Exception B or Exception C in figuring or elimi-

tion 19021 through Section 19027 and Section

nating the estimate penalty. Be sure to check the

Exception:

19142 through Section 19161 to determine the

penalty box on Form 100, line 42; Form 100S,

You can enter an amount less than minimum tax

estimate tax requirement for California.

line 42; or Form 109, line 29. Also see Specific

if you have been granted a tax exemption by the

An S corporation that is a parent of a Qualified

Line Instructions, Part II, Exceptions to the

Franchise Tax Board (FTB), or are subject to

Subchapter S Subsidiary (QSSS) is required to

Penalty.

income tax only under Chapter 3 of the California

pay an $800 annual tax for each QSSS. The

Bank and Corporation Tax Law (i.e., corporations

The term corporation, as used in form

QSSS annual tax is due and payable on the S

that are not doing business within California but

FTB 5806 and in these instructions, includes

corporation’s first estimate installment due date.

derive income from sources within California.)

banks, financial corporations, regulated invest-

The QSSS annual tax is subject to the estimated

ment companies, real estate investment trusts,

Line 4, column (b) – Enter 50% of the amount

tax rules and penalties.

exempt organizations with unrelated business

on line 1 minus the amount entered in

If an S corporation acquires a QSSS during the

taxable income in excess of $1,000, exempt

column (a).

income year, but after the due date of the first

homeowners’ association with nonexempt func-

Line 4, column (c) – Enter 75% of the amount

estimate installment, then the QSSS annual tax

tion taxable income in excess of $100, limited lia-

on line 1 minus the total of the amounts entered

is due with the next required estimate installment

bility companies organized as corporations, and

on line 4, column (a) and column (b).

after the acquisition of the QSSS.

S corporations.

Line 4, column (d) – Enter 100% of the amount

No addition to tax shall apply with respect to any

Income year, as used in form FTB 5806 and in

on line 1 minus the total of the amounts entered

underpayment of estimated tax for any period

these instructions, means taxable year for corpo-

on line 4, column (a), column (b) and column (c).

before April 16, 1999, to the extent the underpay-

rations that are subject to income tax under

ment of an installment for the 1998 income year

Line 5a – The overpayment from a timely filed

Chapter 3 (i.e., corporations that are not doing

was created or increased by the provisions of

prior year return is credited as of the first

business within California but derive income from

Assembly Bill 2797 (Ch. 98-322). To request a

estimate installment due date or the date of

sources within California) of the California Bank

waiver of underpayment of estimated tax penalty:

payment, whichever is later.

and Corporation Tax Law.

•

Complete form FTB 5806 to compute the full

The overpayment from a delinquent filed prior

Tax, for purposes of estimates, includes alterna-

penalty which would normally be due;

year return is credited as of the first estimate

•

tive minimum tax, taxes from Schedule D, excess

Write the word ‘‘Waiver,’’ in red, across the

installment due date, the date of the payment or

net passive income tax, LIFO recapture tax, and

top of form FTB 5806;

the date the delinquent return was filed, which-

•

the minimum franchise tax. This differs from fed-

Attach an explanation to form FTB 5806 that

ever is later.

eral law.

gives the specific law changes that caused

Get federal Rev. Rul. 84-58, 1984-1 C.B. 254, for

the underpayment and show the computation

more information.

Specific Line Instructions

and the amount of penalty to be waived (a

Line 5b – Enter the overpayment from the previ-

second form FTB 5806, clearly marked as

ous installment. However, if an underpayment

such, may be used to show the computation

Part I Figure the Underpayment

existed on any prior installment, pay that

of the penalty not related to the law change);

Generally, an underpayment is the difference

underpayment first.

and

•

between the amount due for each installment of

Attach form FTB 5806 to the face of the

Line 7 – If line 7 shows an underpayment for an

estimated tax and the amount actually paid or

return.

installment, complete Part IV, Exceptions Work-

credited on or before the due date of that install-

sheets and Part II, Exceptions to the Penalty, for

Purpose

ment.

that installment.

Line 1 – Enter the total tax from Form 100,

Corporations may use form FTB 5806 to deter-

Part II Exceptions to the Penalty

line 31; Form 100S, line 31; or Form 109, line 20.

mine if they:

Also include any add-on taxes (except interest

•

The FTB will not assess a penalty if all of the

Paid the correct estimated tax; or

computed under the look-back method for com-

•

estimated tax was paid on time and the pay-

Are subject to the penalty for underpayment

pleted long-term contracts and the increase in

ments satisfied the exception rules. A corporation

of estimated tax, and if so, the amount of the

tax for the deferral of installment sale income) or

may qualify for more than one exception. Com-

penalty.

credits recaptured on Form 100 or Form 100S,

plete Part IV, Exceptions Worksheets, to see if

Estimated tax is a corporation’s expected tax

Schedule J; or Form 109, Schedule K.

the corporation qualifies to use any of the

liability after credits.

Line 2 – Enter in column (a) through column (d)

exceptions.

Caution: A corporation subject to the franchise

the estimated tax installment due dates that cor-

California difference: Under California law, the

tax must always pay at least the required mini-

respond to the 15th day of the 4th, 6th, 9th and

exceptions are computed on a cumulative basis.

mum franchise tax, and any QSSS annual tax if

12th months of the income year.

This differs from federal law which requires only

applicable, by the 15th day of the 4th month of

25% of the annual payment for each installment.

the income year.

Accounting Period Less Than 12 Months (Short Period)

Fiscal year corporations, adjust dates accordingly.

Percentage of Estimated Tax Due On or Before the 15th Day of

Number of

Installments Due

April

June

September

December

If income year (calendar year) begins:

January 1 through January 16

4

25%

50%

75%

100%

January 17 through March 16

3

33

1

⁄

%

66

2

⁄

%

100%

3

3

March 17 through June 15

2

50%

100%

June 16 through September 15

1

100%

September 16 through December 31

None

FTB 5806 Instructions 1998 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2