41ESR

41ESR

41ESR

1998

1998

1998

41ESR

41ESR

1998

1998

F

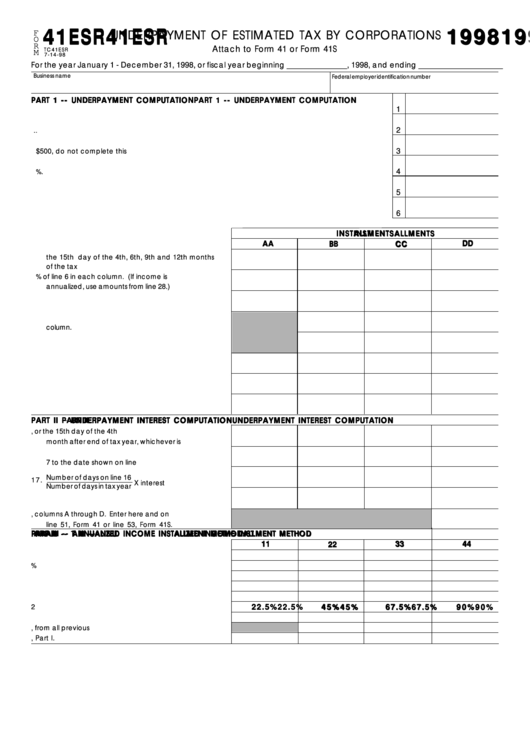

UNDERPAYMENT OF ESTIMATED TAX BY CORPORATIONS

O

R

Attach to Form 41 or Form 41S

TC41ESR

M

7-14-98

For the year January 1 - December 31, 1998, or fiscal year beginning _______________, 1998, and ending _____________________

Business name

Federal employer identification number

PART 1 -- UNDERPAYMENT COMPUTATION

PART 1 -- UNDERPAYMENT COMPUTATION

PART 1 -- UNDERPAYMENT COMPUTATION

PART 1 -- UNDERPAYMENT COMPUTATION

PART 1 -- UNDERPAYMENT COMPUTATION

1

1. Enter the 1998 income tax liability. .....................................................................................................................

2

2. Enter credits for Idaho tax on fuels claimed on the 1998 corporate return. ....................................................

3

3 . Subtract line 2 from line 1. If the result is less than $500, do not complete this form. ...............................

4

4 . Multiply line 3 by 90%. .........................................................................................................................................

5

5. Enter the income tax liability shown on the 1997 tax return. ...........................................................................

6

6. Estimated tax. Enter the smaller of line 4 or line 5. ..........................................................................................

INST

INST

INSTALLMENTS

ALLMENTS

ALLMENTS

ALLMENTS

INST

INST

ALLMENTS

D D D D D

A A A A A

B B B B B

C C C C C

7 . Enter the installment due dates that correspond to

the 15th day of the 4th, 6th, 9th and 12th months

of the tax year ...................................................................

8 . Enter 25% of line 6 in each column. (If income is

annualized, use amounts from line 28.) ...........................

9 . Amount paid or credit for each period ............................

1 0 . Enter the amount from line 14 of the preceding

column. ..............................................................................

1 1 . Amount applied to previous installment ..........................

1 2 . Add lines 9 and 10 and subtract line 11. .......................

1 3 . Underpayment. Subtract line 12 from line 8. ................

1 4 . Overpayment. Subtract line 8 from line 12.

PART II

PART II

PART II

PART II

PART II -- UNDERPAYMENT INTEREST COMPUTATION

UNDERPAYMENT INTEREST COMPUTATION

UNDERPAYMENT INTEREST COMPUTATION

UNDERPAYMENT INTEREST COMPUTATION

UNDERPAYMENT INTEREST COMPUTATION

1 5 . Enter date of payment, or the 15th day of the 4th

month after end of tax year, whichever is earlier. .........

1 6 . Number of days from due date of installment on line

7 to the date shown on line 15 .......................................

Number of days on line 16

1 7 .

X interest rate .....................

Number of days in tax year

1 8 . Multiply line 17 by the underpayment on line 13. ..........

1 9 . Add line 18, columns A through D. Enter here and on

line 51, Form 41 or line 53, Form 41S.

P P P P P AR

AR

ART III --

AR

T III --

T III --

T III -- ANNU

ANNU

ANNU

ANNUALIZED INCOME INST

ALIZED INCOME INST

ALIZED INCOME INST

ALIZED INCOME INSTALLMENT METHOD

ALLMENT METHOD

ALLMENT METHOD

ALLMENT METHOD

AR

T III --

ANNU

ALIZED INCOME INST

ALLMENT METHOD

1 1 1 1 1

3 3 3 3 3

4 4 4 4 4

2 2 2 2 2

2 0 . Enter Idaho annualized taxable income. ..........................

2 1 . Multiply line 20 by 8%. ....................................................

2 2 . Enter other taxes for each payment period. ...................

2 3 . Enter tax credits for each period. ....................................

2 4 . Total tax. Add lines 21 and 22 and subtract line 23. ..

2 2 . 5 %

2 2 . 5 %

2 2 . 5 %

4 5 %

4 5 %

6 7 . 5 %

6 7 . 5 %

9 0 %

9 0 %

2 5 . Applicable percentage .......................................................

2 2 . 5 %

2 2 . 5 %

4 5 %

4 5 %

4 5 %

6 7 . 5 %

6 7 . 5 %

6 7 . 5 %

9 0 %

9 0 %

9 0 %

2 6 . Multiply line 24 by line 25. ...............................................

2 7 . Enter the total of line 28, from all previous columns. ....

2 8 . Subtract line 27 from line 26. Enter on line 8, Part I.

1

1