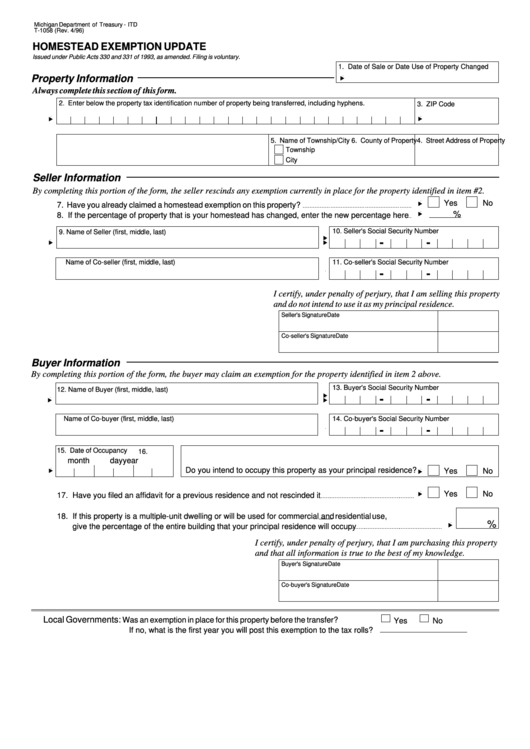

Michigan Department of Treasury - ITD

T-1058 (Rev. 4/96)

HOMESTEAD EXEMPTION UPDATE

Issued under Public Acts 330 and 331 of 1993, as amended. Filing is voluntary.

1. Date of Sale or Date Use of Property Changed

Property Information

Always complete this section of this form.

2. Enter below the property tax identification number of property being transferred, including hyphens.

3. ZIP Code

4. Street Address of Property

5. Name of Township/City

6. County of Property

Township

City

Seller Information

By completing this portion of the form, the seller rescinds any exemption currently in place for the property identified in item #2.

Yes

No

7. Have you already claimed a homestead exemption on this property?

%

8. If the percentage of property that is your homestead has changed, enter the new percentage here

10. Seller's Social Security Number

9. Name of Seller (first, middle, last)

-

-

Name of Co-seller (first, middle, last)

11. Co-seller's Social Security Number

-

-

I certify, under penalty of perjury, that I am selling this property

and do not intend to use it as my principal residence.

Seller's Signature

Date

Co-seller's Signature

Date

Buyer Information

By completing this portion of the form, the buyer may claim an exemption for the property identified in item 2 above.

13. Buyer's Social Security Number

12. Name of Buyer (first, middle, last)

-

-

Name of Co-buyer (first, middle, last)

14. Co-buyer's Social Security Number

-

-

15. Date of Occupancy

16.

month

day

year

Do you intend to occupy this property as your principal residence?

Yes

No

Yes

No

17.

Have you filed an affidavit for a previous residence and not rescinded it

18.

If this property is a multiple-unit dwelling or will be used for commercial and residential use,

%

give the percentage of the entire building that your principal residence will occupy

I certify, under penalty of perjury, that I am purchasing this property

and that all information is true to the best of my knowledge.

Buyer's Signature

Date

Co-buyer's Signature

Date

Local Governments:

Was an exemption in place for this property before the transfer?

Yes

No

If no, what is the first year you will post this exemption to the tax rolls?

1

1