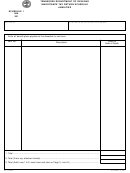

RECAPITULATION - GROSS ESTATE

IMPORTANT: Please attach a copy of Schedules A through K, M and O of the federal estate tax return (FORM 706). Schedule L of

the federal return is not to be included with this return. If you did not file a federal return, the state forms for filing these schedules may

be obtained by contacting the Department of Revenue toll free 1-800-342-1003 in state or (615) 741-2594.

Classification

Alternate

Value at Date

Schedule

of Property

Value

of Death

DOLLARS

CENTS

DOLLARS

CENTS

1.

A

Real Estate .....................................

________________________

________________________

2.

B

Stocks and Bonds ...........................

________________________

________________________

3.

C

Cash, Notes, Mortgages .................

________________________

________________________

4.

D

Insurance on Decendent's Life .......

________________________

________________________

5.

E

Jointly Owned Property ...................

________________________

________________________

6.

F

Miscellaneous Property ..................

________________________

________________________

7.

G

Transfers During Decedent's Life ...

________________________

________________________

8.

H

Powers of Appointment ...................

________________________

________________________

9.

I

Annuities .........................................

________________________

________________________

10.

Total Gross Estate (Add Lines 1 through 9) ........

________________________

________________________

Schedule

Deductions

Amount

DOLLARS

CENTS

11.

J

Funeral Expenses and Administration Expenses ....................................

________________________

12.

K

Debts and Mortgages ...............................................................................

________________________

13.

M

Bequests to Surviving Spouse (Marital Deduction) .................................

________________________

14.

O

Bequests: Public, Charitable, Religious, and Educational .......................

________________________

15.

Amount deductible from gross estate (Add Lines 11 through 14) .................................

________________________

16.

Taxable Estate (Line 10 minus Line 15) .......................................................................

________________________

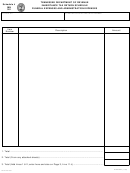

INFORMATION CONCERNING FEDERAL ESTATE TAX RETURN (FORM 706)

1.

Was a federal estate tax return filed?

Yes

No

DOLLARS

CENTS

If yes, answer the following questions concerning entries on the federal return.

2.

Total gross estate ..............................................................................................................

________________________

3.

Total allowable deductions ................................................................................................

________________________

4.

Taxable estate ...................................................................................................................

________________________

5.

Adjusted taxable gifts ........................................................................................................

________________________

6.

Credit for state death taxes available ................................................................................

________________________

INTERNET (1-98)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18