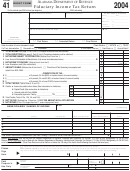

Instructions For Form 101a - Wisconsin Inheritance Tax Return - Wisconsin Department Of Revenue

ADVERTISEMENT

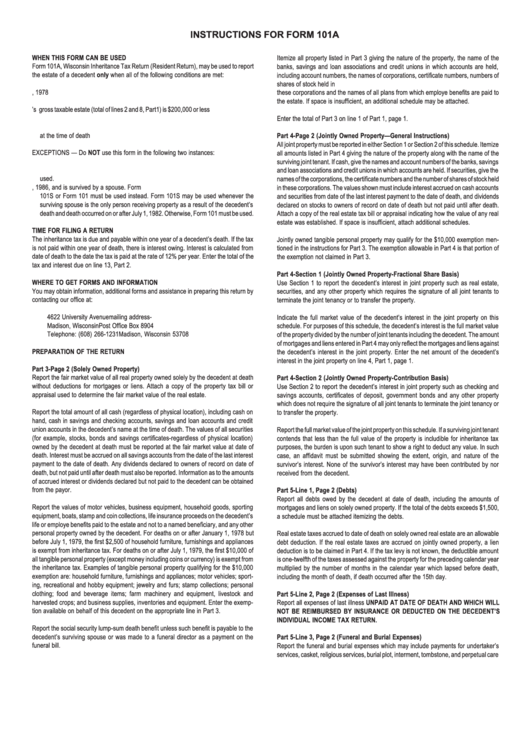

INSTRUCTIONS FOR FORM 101A

WHEN THIS FORM CAN BE USED

Itemize all property listed in Part 3 giving the nature of the property, the name of the

Form 101A, Wisconsin Inheritance Tax Return (Resident Return), may be used to report

banks, savings and loan associations and credit unions in which accounts are held,

the estate of a decedent only when all of the following conditions are met:

including account numbers, the names of corporations, certificate numbers, numbers of

shares of stock held in

1. Date of death is on or after January 1, 1978

these corporations and the names of all plans from which employe benefits are paid to

2. No federal estate tax return is required to be filed

the estate. If space is insufficient, an additional schedule may be attached.

3. The decedent’s gross taxable estate (total of lines 2 and 8, Part1) is $200,000 or less

4. The decedent was a Wisconsin resident at the time of death

Enter the total of Part 3 on line 1 of Part 1, page 1.

5. The decedent did not own real estate or tangible property located outside Wisconsin

at the time of death

Part 4-Page 2 (Jointly Owned Property—General Instructions)

All joint property must be reported in either Section 1 or Section 2 of this schedule. Itemize

EXCEPTIONS — Do NOT use this form in the following two instances:

all amounts listed in Part 4 giving the nature of the property along with the name of the

surviving joint tenant. If cash, give the names and account numbers of the banks, savings

1. One or more of the five conditions mentioned above is not met. Form 101 should be

and loan associations and credit unions in which accounts are held. If securities, give the

used.

names of the corporations, the certificate numbers and the number of shares of stock held

2. The decedent died on or after January 1, 1986, and is survived by a spouse. Form

in these corporations. The values shown must include interest accrued on cash accounts

101S or Form 101 must be used instead. Form 101S may be used whenever the

and securities from date of the last interest payment to the date of death, and dividends

surviving spouse is the only person receiving property as a result of the decedent’s

declared on stocks to owners of record on date of death but not paid until after death.

death and death occurred on or after July 1, 1982. Otherwise, Form 101 must be used.

Attach a copy of the real estate tax bill or appraisal indicating how the value of any real

estate was established. If space is insufficient, attach additional schedules.

TIME FOR FILING A RETURN

The inheritance tax is due and payable within one year of a decedent’s death. If the tax

Jointly owned tangible personal property may qualify for the $10,000 exemption men-

is not paid within one year of death, there is interest owing. Interest is calculated from

tioned in the instructions for Part 3. The exemption allowable in Part 4 is that portion of

date of death to the date the tax is paid at the rate of 12% per year. Enter the total of the

the exemption not claimed in Part 3.

tax and interest due on line 13, Part 2.

Part 4-Section 1 (Jointly Owned Property-Fractional Share Basis)

WHERE TO GET FORMS AND INFORMATION

Use Section 1 to report the decedent’s interest in joint property such as real estate,

You may obtain information, additional forms and assistance in preparing this return by

securities, and any other property which requires the signature of all joint tenants to

contacting our office at:

terminate the joint tenancy or to transfer the property.

4622 University Avenue

mailing address-

Indicate the full market value of the decedent’s interest in the joint property on this

Madison, Wisconsin

Post Office Box 8904

schedule. For purposes of this schedule, the decedent’s interest is the full market value

Telephone: (608) 266-1231

Madison, Wisconsin 53708

of the property divided by the number of joint tenants including the decedent. The amount

of mortgages and liens entered in Part 4 may only reflect the mortgages and liens against

PREPARATION OF THE RETURN

the decedent’s interest in the joint property. Enter the net amount of the decedent’s

interest in the joint property on line 4, Part 1, page 1.

Part 3-Page 2 (Solely Owned Property)

Report the fair market value of all real property owned solely by the decedent at death

Part 4-Section 2 (Jointly Owned Property-Contribution Basis)

without deductions for mortgages or liens. Attach a copy of the property tax bill or

Use Section 2 to report the decedent’s interest in joint property such as checking and

appraisal used to determine the fair market value of the real estate.

savings accounts, certificates of deposit, government bonds and any other property

which does not require the signature of all joint tenants to terminate the joint tenancy or

Report the total amount of all cash (regardless of physical location), including cash on

to transfer the property.

hand, cash in savings and checking accounts, savings and loan accounts and credit

union accounts in the decedent’s name at the time of death. The values of all securities

Report the full market value of the joint property on this schedule. If a surviving joint tenant

(for example, stocks, bonds and savings certificates-regardless of physical location)

contends that less than the full value of the property is includible for inheritance tax

owned by the decedent at death must be reported at the fair market value at date of

purposes, the burden is upon such tenant to show a right to deduct any value. In such

death. Interest must be accrued on all savings accounts from the date of the last interest

case, an affidavit must be submitted showing the extent, origin, and nature of the

payment to the date of death. Any dividends declared to owners of record on date of

survivor’s interest. None of the survivor’s interest may have been contributed by nor

death, but not paid until after death must also be reported. Information as to the amounts

received from the decedent.

of accrued interest or dividends declared but not paid to the decedent can be obtained

from the payor.

Part 5-Line 1, Page 2 (Debts)

Report all debts owed by the decedent at date of death, including the amounts of

Report the values of motor vehicles, business equipment, household goods, sporting

mortgages and liens on solely owned property. If the total of the debts exceeds $1,500,

equipment, boats, stamp and coin collections, life insurance proceeds on the decedent’s

a schedule must be attached itemizing the debts.

life or employe benefits paid to the estate and not to a named beneficiary, and any other

personal property owned by the decedent. For deaths on or after January 1, 1978 but

Real estate taxes accrued to date of death on solely owned real estate are an allowable

before July 1, 1979, the first $2,500 of household furniture, furnishings and appliances

debt deduction. If the real estate taxes are accrued on jointly owned property, a lien

is exempt from inheritance tax. For deaths on or after July 1, 1979, the first $10,000 of

deduction is to be claimed in Part 4. If the tax levy is not known, the deductible amount

all tangible personal property (except money including coins or currency) is exempt from

is one-twelfth of the taxes assessed against the property for the preceding calendar year

the inheritance tax. Examples of tangible personal property qualifying for the $10,000

multiplied by the number of months in the calendar year which lapsed before death,

exemption are: household furniture, furnishings and appliances; motor vehicles; sport-

including the month of death, if death occurred after the 15th day.

ing, recreational and hobby equipment; jewelry and furs; stamp collections; personal

clothing; food and beverage items; farm machinery and equipment, livestock and

Part 5-Line 2, Page 2 (Expenses of Last Illness)

harvested crops; and business supplies, inventories and equipment. Enter the exemp-

Report all expenses of last illness UNPAID AT DATE OF DEATH AND WHICH WILL

tion available on behalf of this decedent on the appropriate line in Part 3.

NOT BE REIMBURSED BY INSURANCE OR DEDUCTED ON THE DECEDENT’S

INDIVIDUAL INCOME TAX RETURN.

Report the social security lump-sum death benefit unless such benefit is payable to the

decedent’s surviving spouse or was made to a funeral director as a payment on the

Part 5-Line 3, Page 2 (Funeral and Burial Expenses)

funeral bill.

Report the funeral and burial expenses which may include payments for undertaker’s

services, casket, religious services, burial plot, interment, tombstone, and perpetual care

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2