Form Sf-Sac - Audits Of States, Local Governments, And Non-Profit Organizations Page 11

ADVERTISEMENT

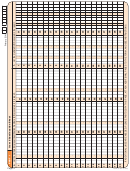

Major Program

Column (g) - Major program

Indicate if the Federal program is a major program, as defined in §__.520 of the Circular by marking (X) in

the appropriate box to indicate either "Yes" or "No".

Column (h) - If yes, type of audit report

If Part III, Item 9(g) "Major program" is marked "Yes", enter one letter (U, Q, A, or D) corresponding to the

type of audit report on the major program in the adjacent box. Enter either ’U’ for Unqualified opinion, ‘Q’

for Qualified opinion, ‘A’ for Adverse opinion, or ‘D’ for Disclaimer of opinion. For clusters, the type of

audit report must apply to the program as a whole. Therefore, all programs in a cluster should share the

same type of audit report and each line should be filled in completely.

If the program is not a major program, leave the "type of audit report" box (h) blank.

Example: A major program must have a type of audit report marked. Do not mark the type of

audit report box for non-major programs.

9. – Continued

10. AUDIT FINDINGS

Major Programs

Type(s) of

Audit Finding

Major

If yes, type

compliance

reference

program

of audit

4

requirement(s)

number(s)

3

report

(f)

(g)

(h)

(a)

(b)

x

Yes

1

No

AFG

2004-2

Q

2

x

Yes

1

O

N/A

No

U

2

Yes

1

x

No

B

2004-3

2

Note: If two lines are listed for the same CFDA number because part of the award is direct and part indirect

(see the example in Part III, Item 9f), the auditor should repeat the major program information on each line.

If the program is not a major program, leave the "Opinion" box blank.

Item 10 - Audit Findings

The rows of Item 10 directly correspond to matching rows in Item 9. The information to complete columns

(a) and (b) is obtained from the Schedule of Findings and Questioned Costs prepared by the auditor. If the

Schedule of Findings and Questioned Costs does not identify audit findings for a specific row, the auditor

should enter "O" for item (a) and "N/A" for item (b). Audit findings affecting more than one major program

should be listed for all major programs affected.

Column (a) - Type(s) of Compliance Requirement(s)

Using the list provided on the form in footnote 4 on page 3, enter the letter(s) that correspond to the type(s)

of compliance requirement(s) applicable to the audit findings (i.e., noncompliance, reportable conditions

(including material weaknesses), questioned costs, fraud and other items reported under §__.510(a))

reported for each Federal program. Do not list all types of compliance requirements that were tested.

Normally, audit findings will be covered by the 14 types of compliance requirements described in Part 3 of

the "OMB Circular A-133 Compliance Supplement." If there is an audit finding, but it is not covered by one

of these, enter "P" for "Other." If there were no audit findings, enter "O" for "None." Enter the letters only,

do not enter commas or spaces.

Column (b) - Audit Finding Reference Number(s)

Enter the audit finding reference number(s) for audit findings (i.e., noncompliance, reportable conditions

(including material weaknesses), questioned costs, fraud, and other items reported under §__.510(a)) in the

Schedule of Findings and Questioned Costs. If no audit findings were reported, enter N/A for "Not

applicable" (footnote 5).

SF-SAC(I) (5-2004)

Page 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14