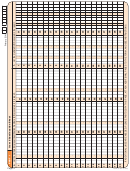

Form Sf-Sac - Audits Of States, Local Governments, And Non-Profit Organizations Page 8

ADVERTISEMENT

Item 1 - Type of Audit Report

If the audit report for the financial statements as a whole is unqualified, mark box 1 "Unqualified opinion." If

the audit report for the financial statements is other than unqualified, mark box(es) 2 "Qualified opinion," 3

"Adverse opinion," and/or 4 "Disclaimer of opinion," as applicable.

Audits of state and local governments often result in the auditor providing multiple opinions on various

opinion units within the financial statements. In situations where there are unqualified opinions on some

opinion units and modified opinions or disclaimers of opinions on others, multiple boxes should be checked

in response to this question. For example, if the financial statements for an auditee includes a qualified

opinion for one opinion unit, a disclaimer of opinion for a second opinion unit, and unqualified opinion on

the remaining opinion units, then mark boxes 2 and 4, but not 1 and 3. Box 1 is only marked for an

unqualified opinion on the financial statements as a whole or when unqualified opinions are provided on all

opinion units.

Item 2 - Mark either "Yes" or "No" to indicate the existence of a “going concern” explanatory paragraph in

the audit report.

Item 3 - Mark either "Yes" or "No" to indicate the disclosure of a "reportable condition."

Item 4 - Skip this item if Item 3 is marked "No." Mark either "Yes" or "No" to indicate the disclosure of a

reportable condition reported as a "material weakness."

Item 5 - Mark either "Yes" or "No" to indicate the disclosure of a "material noncompliance."

PART III - FEDERAL PROGRAMS

The auditor completes this section of the form.

Item 1 - Does the auditor’s report include a statement that the auditee’s financial statements

include departments, agencies, or other organizational units expending $500,000 or more in

Federal awards that have separate A-133 audits which are not included in this audit (AICPA

Audit Guide, Chapter 12)?

According to the AICPA Audit Guide, (to be published in summer 2004) if the audit of Federal awards did

not encompass the entirety of the auditee’s operations expending Federal awards, the operations that are

not included should be identified in a separate paragraph following the first paragraph of the report on

major programs. In Part III, Item 1, mark either "Yes" or "No" to indicate the presence of such a paragraph

for any departments, agencies, or other organizational units not included in the audit which expended

$500,000 or more in Federal awards during the fiscal period.

Item 2 - Dollar Threshold to Distinguish Type A and Type B Programs

Enter the dollar threshold used to distinguish between Type A and Type B programs as defined in

§__.520(b) of the Circular. The dollar threshold must be $300,000 or higher. Round to the nearest dollar.

Item 3 - Low-Risk Auditee

Mark either "Yes" or "No" to indicate if the auditee qualifies as a low-risk auditee under §__.530 of the

Circular.

Item 4 - Reportable Conditions

Mark either "Yes" or "No" to indicate if the Schedule of Findings and Questioned Costs includes any reportable

conditions in internal control for major programs.

Item 5 - Material Weaknesses

If Item 4 is marked "No," skip Item 5. If Item 4 is marked "Yes," mark Item 5 either "Yes" or "No" to indicate if

any reportable conditions are material weaknesses.

Item 6 - Questioned Costs

Mark either "Yes" or "No" to indicate if the Schedule of Findings and Questioned Costs discloses any known

questioned costs.

Item 7 - Prior Audit Findings

Mark either "Yes" or "No" to indicate if the Summary Schedule of Prior Audit Findings reports the status of

any audit findings relating to direct Federal awards expended. If "Yes", identify the Federal agency(ies)

with prior direct findings in Part III, Item 8.

Item 8 - Federal Agencies Required to Receive the Reporting Package

Mark (X) the appropriate box to indicate each Federal awarding agency required to receive a copy of the

reporting package pursuant to §__.320(d) of the Circular. A Federal agency should be marked only if the

Schedule of Findings and Questioned Costs discloses audit findings relating to Federal awards the Federal

awarding agency provided directly OR the Summary Schedule of Prior Audit Findings reports the status of

any audit findings relating to Federal awards that the Federal awarding agency provided directly. If a

Federal agency is not included in the list, enter the two-digit prefix from Appendix I of these instructions in

the "Other" box.

Note: Some CFDA prefixes are used by more than one Federal Agency. Enter the same CFDA prefix used

on the Federal award application. If the auditor identified audit finding(s) for a direct award, identify the

specific Federal agency to which the Federal Audit Clearinghouse is required to distribute audit copies.

SF-SAC(I) (5-2004)

Page 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14