Clear This Page

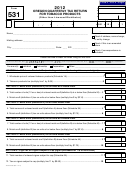

Page 2—First Quarter

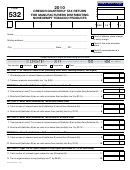

Form 530—Oregon Quarterly Tax Return for Tobacco Distributors—Tax Year 2010

SECTION 4—Chewing Tobacco Tax

•

1 6. Wholesale price of untaxed chewing tobacco (Schedule 4A)........................................................... 16

•

17. Wholesale price of chewing tobacco eligible for credits (Schedule 4B) . .......................................... 17

•

1 8. Wholesale price of chewing tobacco sold into other states (Schedule 4C) ..................................... 18

1 9. Net wholesale price of untaxed chewing tobacco (line 16 minus lines 17 and 18) . .......................... 19

2 0. Chewing tobacco tax (multiply line 19 by 0.65) . ................................................................................ 20

SECTION 5—Cigar Tax on Cigars Subject to Cap (cigars purchased for 77¢ or more each)

•

2 1. Number of untaxed cigars (Schedule 5A) ......................................................................................... 21

•

2 2. Number of cigars eligible for credits (Schedule 5B) . ........................................................................ 22

•

2 3. Number of cigars sold into other states (Schedule 5C) ................................................................... 23

2 4. Net number of taxable cigars (line 21 minus lines 22 and 23) .......................................................... 24

2 5. Tax on cigars subject to cap (multiply line 24 by $0.50) ................................................................... 25

SECTION 6—Cigar Tax on Cigars Below Cap (cigars purchased for less than 77¢ each)

•

2 6. Wholesale price of untaxed cigars (Schedule 6A) ............................................................................ 26

•

27. Wholesale price of cigars eligible for credits (Schedule 6B) . ............................................................ 27

•

2 8. Wholesale price of cigars sold into other states (Schedule 6C) ....................................................... 28

2 9. Net wholesale price of untaxed cigars (line 26 minus lines 27 and 28) ............................................ 29

3 0. Tax on cigars below cap (multiply line 29 by 0.65) . ........................................................................... 30

SECTION 7—Tax Summary

•

3 1. Tax credit carryover from last quarter (enter number as a negative) ................................................ 31

32. Quarterly tax due (add lines 5, 10, 15, 20, 25, 30, and 31) ................................................................ 32

3 3. Quarterly tax discount (multiply line 32 by 0.015) ............................................................................. 33

•

3 4. TAX DUE (line 32 minus line 33) ........................................................................................................ 34

3 5. Penalty and/or interest (see instructions) .......................................................................................... 35

3 6. Total amount due (add lines 34 and 35) ........................................................................................... 36

DECLARATION

I declare under the penalties for false swearing [ORS 305.990(4)] that I have examined this document and to the best of

my knowledge it is true, correct, and complete.

Signature

Date

PRINT name signed above

Title

Telephone number

(

)

Please read the instructions on page 9

150-605-004 (Rev. 12-09)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9