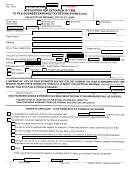

SECTION A-1 - BUSINESS EXPENSE DEDUCTIONS

ITEM

AMOUNT

ITEM

AMOUNT

1. Car and Truck Expense

8. Rent

2. Commissions

9. Repairs

10. Taxes (Except Federal, State and

3. Depreciation

Local Income Taxes)

4. Dues and Publications

11. Utilities and Telephone

5. Insurance

12. Wages and Salaries

6. Legal and Professional

13. Other Deductions (itemized list required)

Total – Enter on line 6, Section A

7. Office Expense and Supplies

SECTION A-2 - INFORMATIONAL DISBURSEMENT (Print N/A if Not Applicable)

TO WHOM PAID

Amount or

Total Amount

Percent Earned

FEIN/SSN

Paid

Name

Address

City, State, Zip

Within the City

(Please attach additional sheets or 1099-Misc. as necessary.)

SECTION

B WORKSHEET - BUSINESS ALLOCATION OF TAXABLE NET PROFIT

All applicable fields must be completed.

Within & Without

Percentage Within

Within

Please attach a list of all business locations.

St. Louis

St. Louis

St. Louis

1.

(a) Average Value of Real and Tangible Personal

Property, including inventory.

(b) Gross Receipts

(c) Wages & Salaries (except Officers)

Total Percentage %

2.

ALLOCATION PERCENTAGE:

Total of Percentages divided by number of factors used

%. Enter this percent on line 8a. Section B.

SECTION B-1 – PARTNER’S SHARE OF NET PROFIT

Non-resident partners use the allocation % from Section B. Partners who are residents of St. Louis are subject to tax on their full

share of the net profit and cannot allocate.

Share of

Allocation

Taxable

List Partners Below

Net Profit

Percentage

Income

Name

FEIN/SSN

Home Address

Zip

Name

FEIN/SSN

Home Address

Zip

(Attach list if necessary)

Enter total “Taxable Income” on line 9, Section C

SECTION C-1 – PAYROLL EXPENSE TAX CREDIT

1.

Did you pay the Payroll Expense Tax on Form P-10?

No (P-10 credit does not apply)

2.

Total quarterly Payroll Expense Tax paid from line 3, Form P-10.

st

Qtr.

nd

Qtr.

rd

Qtr.

th

Qtr.

1

+ 2

+ 3

+ 4

=

3.

4.

Tax amount due from line 10, Section C (reverse side)

Smaller of lines 3 and 4 (Please enter this amount on line 11, Section C)

5.

1

1 2

2