Eta Form 9061 - Work Opportunity Tax Credit Page 3

ADVERTISEMENT

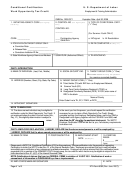

INSTRUCTIONS FOR COMPLETING THE INDIVIDUAL CHARACTERISTICS FORM (ICF), ETA 9061. This form is used together with IRS Form 8850 to

help state workforce agencies (SWAs) determine eligibility for the Work Opportunity Tax Credit (WOTC) Program. The form may be completed, on behalf of

the applicant, by: 1) the employer or employer representative, the SWA, a participating agency, or 2) the applicant directly (if a minor, the parent or guardian

must sign the form) and signed (Box 24a.) by the individual completing the form. This form is required to be used, without modification, by all employers (or their

representatives) seeking WOTC certification. Every certification request must include an IRS Form 8850 and an ETA Form 9061 or 9062, if a Conditional

Certification was issued to the individual pre-certifying the new hire as “eligible” under the requested target group.

Boxes 1 and 2. SWA. For agency use only.

Boxes 3-5.

Employer Information. Enter the name, address including ZIP code, telephone number, and employer Federal ID number (EIN) of the

employer requesting the certification for the WOTC. Do not enter information pertaining to the employer’s representative, if any.

Applicant Information. Enter the applicant’s name and social security number as they appear on the applicant’s social security

Boxes 6-11.

card. In Box 8, indicate whether the applicant previously worked for the employer, and if Yes, enter the last date or approximate last

date of employment. This information will help the “48-hour” reviewer to, early in the verification process, eliminate requests for

former employees and to issue denials to these type of requests, or certifications in the case of “qualifying rehires” during valid

“breaks in employment” (see pages III-12 and III-13, Nov. 2002, Third Ed., ETA Handbook 408) during the first year of employment.

Boxes 12-22. Applicant Characteristics. Read questions carefully, answer each question, and provide additional information where requested.

On January 2, 2013, President Obama signed into law the American Taxpayer Relief Act of 2012 retroactively authorizing the Empowerment Zones

(EZs) and WOTC non-veteran groups from December 31, 2011 through December 31, 2013. This Act also authorized continuation of the VOW Act

of 2011 expanded veterans and provisions through December 31, 2013. Form Updates. “Empowerment Zones” was added to Box 18 to capture

data for Designated Community Residents who must reside in a Rural Renewal County or EZ to be determined eligible for WOTC certification. A

new Box 19 was added to this form to capture information on the Summer Youth group activated when the EZs were reauthorized. Members of the

Summer Youth group must reside in an EZ to be determined eligible for WOTC certification. Boxes 19-21 were renumbered and are now Boxes 20 -

22. Box 22 below became Box 23, Sources to Document Eligibility.

Box 23

Sources to Document Eligibility. The applicant or employer is requested to provide documentary evidence to substantiate the YES answers in

Boxes 12 through 22. List or describe the documentary evidence that is attached to the ICF or that will be provided to the SWA. Indicate in

parentheses next to each document listed whether it is attached (A) or forthcoming (F). Some examples of acceptable documentary evidence are

provided below. A letter from the agency that administers a relevant program may be furnished specifically addressing the question to which the

applicant answered YES. For example, if an applicant answers YES to either question in Box 14 and enters the name of the primary recipient and the

city and state in which the benefits were received, the applicant could provide a letter from the appropriate SNAP (formerly Food Stamp) agency

stating to whom SNAP benefits were paid, the months for which they were paid, and the names of the individuals included on the grant for each

month. SWAs will use this box to document the sources used when verifying target group eligibility, followed by their initials and the date the

determination was completed.

Examples of Documentary Evidence and Collateral Contacts. Employers/Consultants: You may check with

your SWA to find out what other sources you can use to prove target group eligibility. (You are encouraged to provide

copies of documentation or names of collateral contacts for each question for which you answered YES.)

2

Signed Letter of Separation or related document from

QUESTION 12

authorized Individual on DVA letterhead or agency stamp

Birth Certificate

with specific description of months benefits were received.

Driver’s License

For SWAs: To determine Ticket Holder (TH) eligibility, Fax

1

School I.D. Card

page 1 of Form 8850 to MAXIMUS at: 703-683-1051 to

1

Work Permit

verify if applicant: 1) is a TH, and 2) has an Individual Work

1

Federal/State/Local Gov’t I.D.

Plan from an Employment Network.

Copy of Hospital Record of Birth

QUESTION 17

QUESTION 13

Parole Officer’s Name or Statement

DD-214 or Discharge Papers

Correction Institution Records

Reserve Unit Contacts or Letters of Separation

Court Records Extracts

Letter issued only by the Department of Veterans Affairs

(VA) on VA Letterhead or bearing the Agency Stamp, with

QUESTIONS 18 & 19

signature, certifying Veteran status or that the Veteran has

a service-connected disability.

To determine if a Designated Community Resident (DCR)

lives in a Rural Renewal County, visit the site:

QUESTIONS 14 & 16

Click on Find Zip Code; Enter & Submit

Address/Zip Code; Click on Mailing Industry Information;

TANF/SNAP (Food Stamp) Benefit History

Download and Print the Information, then compare the

Signed statement from Authorized Individual with a specific

county of the address to the list in the Instructions to IRS

description of the months benefits that were received

Form 8850.

Case number identifier

To determine if the DCR or a Summer Youth lives in an

Empowerment Zone, check the Instructions to IRS Form

QUESTION 15

8850, or visit the U.S. Department of Housing and Urban

Development’s “locator” at:

Vocational Rehabilitation Agency Contact

Veterans Administration for Disabled Veterans

ETA Form 9061 – (Rev. July 2013)

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4