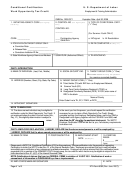

Eta Form 9061 - Work Opportunity Tax Credit Page 4

ADVERTISEMENT

QUESTION 20

QUESTIONS 21 & 22

SSI Record or Authorization

Unemployment Insurance (UI) Claims Records

SSI Contact

UI Wage Records

Evidence of SSI Benefits

Box 24(a). Signature. The person who completes the form signs the signature block.

Box 24(b). Signatory Options. Qualified individuals/entities which can sign the form instead of the applicant: (a) Employer, (b) Consultant, (c) SWA staff, (d)

Participating Agency staff, (e) Applicant, or (f) Parent or guardian (If applicant is a minor, the parent or guardian must sign).

Box 25.

Date. Enter the month, day and year when the form was completed.

Persons are not required to respond to this collection of information unless it displays a currently valid OMB Control Number. Respondent’s obligation to reply to these

questions is required to obtain and retain benefits per law 104-188. Public reporting burden for this collection of information is estimated to average 20 minutes per

response including the time for reading instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the

information. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing burden to the U.S.

Department of Labor, Employment and Training Administration, Division of National Programs, Tools, and Technical Assistance, 200 Constitution Ave., NW,

Room C-4510, Washington, D.C. 20210 (Paperwork Reduction Project Control No. 1205-0371).

………………………………………………………………………………………………………………………………………………………………………………......

(Cut along dotted line and keep in your files)

TO: THE JOB APPLICANT OR EMPLOYEE,

Privacy Act Statement: The Internal Revenue Code of 1986, Section 51, as amended and its enacting

legislation, P.L. 104-188, specify that the State Workforce Agencies are the "designated" agencies

responsible for administering the WOTC certification procedures of this program. The information you have

provided completing this form will be disclosed by your employer to the State Workforce Agency. Provision

of this information is voluntary. However, the information is required for your employer to receive the

federal tax credit. IF THE INFORMATION YOU PROVIDE IS ABOUT A MEMBER OF YOUR FAMILY,

YOU SHOULD PROVIDE HIM/HER A COPY OF THIS NOTICE.

__________________

1. Where a Federal/State/Local Gov’t., School I.D. Card, or Work Permit does not contain age or birth date, another valid document must be

obtained to verify an individual’s age.

2. ESPL No. 05-98, dated 3/18/98, officially rescinded the authority to use Form I-9 as proof of age and residence. Therefore, the I-9 is not a

valid piece of documentary evidence since May 1998.

ETA Form 9061 – (Rev. July 2013)

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4