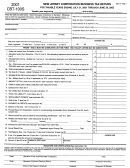

Form Ct-1120cr - Combined Corporation Business Tax Return - 2001 Page 2

ADVERTISEMENT

1.

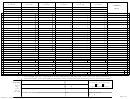

PARENT OR DESIGNATED

CT PARENT CORPORATION

ENTER CORPORATION NAMES

ENTER CONNECTICUT TAX REGISTRATION NUMBERS

- 000

ENTER FEDERAL EMPLOYER ID NUMBERS

PART II

1. Form CT-1120, Computation of Net Income , Line 1, (federal taxable income (loss) before net operating loss and special deductions) ............

1

A

2. Interest income wholly exempt from federal tax ................................................................................................................................................

2

D

3. Unallowable deduction for corporation tax (from Form CT-1120, Schedule F , Line 8) ......................................................................................

3

D

4. Intangible expenses and interest expenses paid to a related member (See instructions) ...................................................................................

4

5. TOTAL (Add Lines 1, 2, 3, and 4) .....................................................................................................................................................................

5

6. Dividends (a) Dividends from domestic companies less than 20% owned

Limited to 70% deduction___________ (less related expenses_______________ ..................................................................... 6a

D

(b) Other dividends ____________________ (less related expenses) ________________ ............................................................. 6b

E

(c) Intercorporate dividends from corporations included in this combined return .............................................................................. 6c

D

7. Capital loss carryover if not deducted in computing federal capital gain (Attach schedule) ................................................................................

7

U

8. Capital gain from sale of preserved land ...........................................................................................................................................................

8

C

9. Other (Attach explanation) ...............................................................................................................................................................................

9

T

10. TOTAL (Add Lines 6a, 6b, 6c, 7, 8, and 9) ...................................................................................................................................................... 10

11. NET INCOME (Loss) Subtract Line 10 from Line 5. If 100% Connecticut, enter also on Line 13 .......................................................................... 11

12. Apportionment fraction (Form CT-1120, Schedule A, Line 2. Carry to six places.) .......................................................................................... 12

0.

13. Connecticut net income (Line 11, or Line 11 multiplied by Line 12) ...................................................................................................................... 13

14. Operating loss carryover from separate return year (Cannot exceed amount on Line 13. Attach schedule.) .................................................... 14

15. Net income (Subtract Line 14 from Line 13) ....................................................................................................................................................... 15

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

16. Combined net income (Add all amounts on Line 15. Enter on Page 3, Line 16, Combined Total Column.) ........................................................... 16

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

17. Operating loss carryover from combined return year (Cannot exceed amount on Line 16. Attach schedule.) ................................................... 17

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

18. Income subject to tax (Subtract Line 17 from Line 16) ....................................................................................................................................... 18

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

19. TAX: Multiply Line 18 by 7.5% (.075) (Enter here and on Part IV, Line 2a) .......................................................................................................... 19

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

PART III

1. Form CT-1120, Schedule D , Line 6, Column C. If 100% Connecticut, enter also on Line 3 (See instructions) ..................................................

1

2. Apportionment fraction (Form CT-1120, Schedule B, Line 2. Carry to six places) .......................................................................................

2

0.

3. Line 1, or Line 1 multiplied by Line 2 ..............................................................................................................................................................

3

4. Number of months covered by this return .....................................................................................................................................................

4

5. Line 3 multiplied by Line 4, divided by 12 .......................................................................................................................................................

5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

6. Combined minimum tax base (Add all amounts on Line 5. Enter on Page 3, Line 6, Combined Total Column.) ................................................

6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

7. TAX: Multiply Line 6 by .0031 (3 1/10 mills per dollar) ...................................................................................................................................

7

FORM CT-1120CR (Rev. 12/01)

Page 2 of 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6