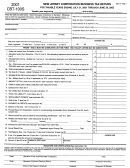

Form Ct-1120cr - Combined Corporation Business Tax Return - 2001 Page 6

ADVERTISEMENT

PART II - CARRYFORWARD CREDITS

FROM PREVIOUS INCOME YEARS

A

B

C

Total Amount of

Name of Affiliate

A m o u n t

Carryforward Credit

Applied

Computing Credit

1 Air Pollution

2 Industrial Waste

3 Child Day Care

4 Housing Program Contribution

5 Clean Alternative Fuel

6 Employer-Assisted Housing

7 Electronic Data Processing Equipment Property Tax

8 Research and Development

9 Research and Experimental Expenditures

10 Hiring Incentive

11 Fixed Capital Investment

12 Human Capital Investment

13 Insurance Reinvestment Fund

14 Small Business Administration Guaranty Fee

15 Historic Homes Rehabilitation

16 Donation of Open Space Land

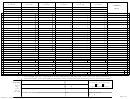

1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 1

17 TOTAL PART II (Add Lines 1 through 16)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1

PART III - TOTAL TAX CREDITS

Amount Applied

TOTAL TAX CREDITS (Add Part I, Lines 1, 5, 13, 26, 27, Column A, and Part II, Line 17,

18

Column B. Enter total here and on Part IV, Computation of Amount Payable , Line 5)

Page 6 of 6

FORM CT-1120CR (Rev. 12/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6