Alaska State Automated Payment Tax Division Enrollment Form Instructions

ADVERTISEMENT

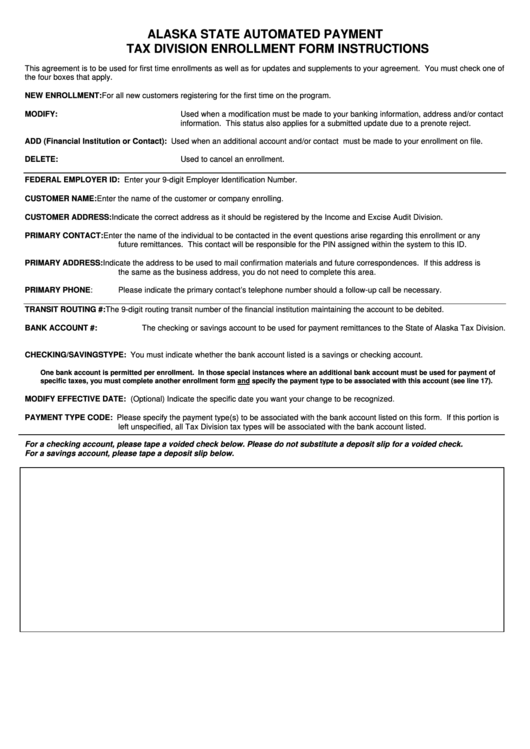

ALASKA STATE AUTOMATED PAYMENT

TAX DIVISION ENROLLMENT FORM INSTRUCTIONS

This agreement is to be used for first time enrollments as well as for updates and supplements to your agreement. You must check one of

the four boxes that apply.

NEW ENROLLMENT:

For all new customers registering for the first time on the program.

MODIFY:

Used when a modification must be made to your banking information, address and/or contact

information. This status also applies for a submitted update due to a prenote reject.

ADD (Financial Institution or Contact):

Used when an additional account and/or contact must be made to your enrollment on file.

DELETE:

Used to cancel an enrollment.

FEDERAL EMPLOYER ID: Enter your 9-digit Employer Identification Number.

CUSTOMER NAME:

Enter the name of the customer or company enrolling.

CUSTOMER ADDRESS: Indicate the correct address as it should be registered by the Income and Excise Audit Division.

PRIMARY CONTACT:

Enter the name of the individual to be contacted in the event questions arise regarding this enrollment or any

future remittances. This contact will be responsible for the PIN assigned within the system to this ID.

PRIMARY ADDRESS:

Indicate the address to be used to mail confirmation materials and future correspondences. If this address is

the same as the business address, you do not need to complete this area.

PRIMARY PHONE:

Please indicate the primary contact’ s telephone number should a follow-up call be necessary.

TRANSIT ROUTING #:

The 9-digit routing transit number of the financial institution maintaining the account to be debited.

BANK ACCOUNT #:

The checking or savings account to be used for payment remittances to the State of Alaska Tax Division.

CHECKING/SAVINGS TYPE: You must indicate whether the bank account listed is a savings or checking account.

One bank account is permitted per enrollment. In those special instances where an additional bank account must be used for payment of

specific taxes, you must complete another enrollment form and specify the payment type to be associated with this account (see line 17).

MODIFY EFFECTIVE DATE: (Optional) Indicate the specific date you want your change to be recognized.

PAYMENT TYPE CODE: Please specify the payment type(s) to be associated with the bank account listed on this form. If this portion is

left unspecified, all Tax Division tax types will be associated with the bank account listed.

For a checking account, please tape a voided check below. Please do not substitute a deposit slip for a voided check.

For a savings account, please tape a deposit slip below.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4