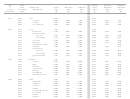

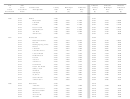

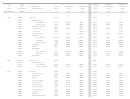

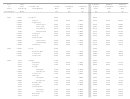

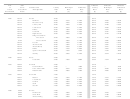

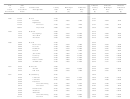

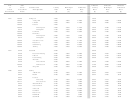

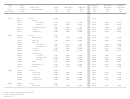

Tax Rates And Effective Tax Rates Sheet - 2011-2012 Page 13

ADVERTISEMENT

Year

2011

Effective

Effective

Effective

of

Sales

Counties and

County

Municipal

Combined

County

Municipal

Combined

Latest

Assessment

Muncipalities

Rate

Rate

Rate

Rate

Rate

Rate

Revaluation

Ratio

[$]

[$]

[$]

[$]

[$]

[$]

2004

1.0372

Guilford

.7824

.8115

1.0372

Archdale:

1.0372

In Guilford

.7824

.2900

1.0724

.8115

.3008

1.1123

.9748

In Randolph

.5860

.2900

.8760

.5712

.2827

.8539

1.0372

Burlington

1.0372

In Guilford

.7824

.5800

1.3624

.8115

.6016

1.4131

1.0372

In Alamance

.5200

.5800

1.1000

.5393

.6016

1.1409

1.0372

Gibsonville:

1.0372

In Guilford

.7824

.5100

1.2924

.8115

.5290

1.3405

1.0372

In Alamance

.5200

.5100

1.0300

.5393

.5290

1.0683

1.0372

Greensboro

.7824

.6325

1.4149

.8115

.6560

1.4675

1.0372

High Point:

1.0372

In Guilford

.7824

.6620

1.4444

.8115

.6866

1.4981

1.0054

In Davidson

.5400

.6620

1.2020

.5429

.6656

1.2085

1.0390

In Forsyth

.6740

.6620

1.3360

.7003

.6878

1.3881

.9748

In Randolph

.5860

.6620

1.2480

.5712

.6453

1.2166

1.0372

Jamestown

.7824

.3900

1.1724

.8115

.4045

1.2160

1.0372

Kernersville:

1.0372

In Guilford

.7824

.4975

1.2799

.8115

.5160

1.3275

1.0390

In Forsyth

.6740

.4975

1.1715

.7003

.5169

1.2172

1.0372

Oak Ridge

.7824

.0863

.8687

.8115

.0895

.9010

1.0372

Pleasant Garden

.7824

.0250

.8074

.8115

.0259

.8374

1.0372

Sedalia

.7824

.2750

1.0574

.8115

.2852

1.0967

1.0372

Stokesdale

.7824

…

.7824

.8115

…

.8115

1.0372

Summerfield

.7824

.0350

.8174

.8115

.0363

.8478

1.0372

Whitsett

.7824

.0500

.8324

.8115

.0519

.8634

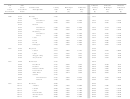

2007

.9550

Halifax

.6800

.6494

.9550

Enfield

.6800

.7500

1.4300

.6494

.7163

1.3657

.9550

Halifax

.6800

.5500

1.2300

.6494

.5253

1.1747

.9550

Hobgood

.6800

.5700

1.2500

.6494

.5444

1.1938

.9550

Littleton

.6800

.6500

1.3300

.6494

.6208

1.2702

.9550

Roanoke Rapids

.6800

.6240

1.3040

.6494

.5959

1.2453

.9550

Scotland Neck

.6800

.6400

1.3200

.6494

.6112

1.2606

.9550

Weldon

.6800

.6600

1.3400

.6494

.6303

1.2797

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30