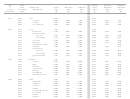

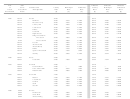

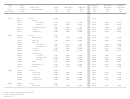

Tax Rates And Effective Tax Rates Sheet - 2011-2012 Page 22

ADVERTISEMENT

Year

2011

Effective

Effective

Effective

of

Sales

Counties and

County

Municipal

Combined

County

Municipal

Combined

Latest

Assessment

Muncipalities

Rate

Rate

Rate

Rate

Rate

Rate

Revaluation

Ratio

[$]

[$]

[$]

[$]

[$]

[$]

.9929

Grifton:

.9929

In Pitt

.6650

.6000

1.2650

.6603

.5957

1.2560

1.0296

In Lenoir

.8000

.6000

1.4000

.8237

.6178

1.4414

.9929

Grimesland

.6650

.4800

1.1450

.6603

.4766

1.1369

.9929

Simpson

.6650

.4500

1.1150

.6603

.4468

1.1071

.9929

Winterville

.6650

.4500

1.1150

.6603

.4468

1.1071

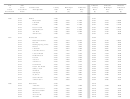

2009

.8857

Polk

.5200

.4606

.8857

Columbus

.5200

.3900

.9100

.4606

.3454

.8060

.8857

Saluda:

.8857

In Polk

.5200

.5500

1.0700

.4606

.4871

.9477

.9500

In Henderson

.5136

.5500

1.0636

.4879

.5225

1.0104

.8857

Tryon

.5200

.4778

.9978

.4606

.4232

.8838

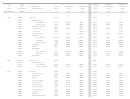

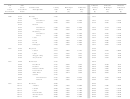

2007

.9748

Randolph

.5860

.5712

.9748

Archdale:

.9748

In Randolph

.5860

.2900

.8760

.5712

.2827

.8539

1.0372

In Guilford

.7824

.2900

1.0724

.8115

.3008

1.1123

.9748

Asheboro

.5860

.5500

1.1360

.5712

.5361

1.1074

.9748

Franklinville

.5860

.4200

1.0060

.5712

.4094

.9806

.9748

High Point:

.9748

In Randolph

.5860

.6620

1.2480

.5712

.6453

1.2166

1.0054

In Davidson

.5400

.6620

1.2020

.5429

.6656

1.2085

1.0390

In Forsyth

.6740

.6620

1.3360

.7003

.6878

1.3881

1.0372

In Guilford

.7824

.6620

1.4444

.8115

.6866

1.4981

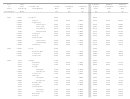

.9748

Liberty

.5860

.5125

1.0985

.5712

.4996

1.0708

.9748

Ramseur

.5860

.5800

1.1660

.5712

.5654

1.1366

.9748

Randleman

.5860

.5800

1.1660

.5712

.5654

1.1366

.9748

Seagrove

.5860

.4000

.9860

.5712

.3899

.9612

.9748

Staley

.5860

.1250

.7110

.5712

.1219

.6931

.9748

Thomasville:

.9748

In Randolph

.5860

.5600

1.1460

.5712

.5459

1.1171

1.0054

In Davidson

.5400

.5600

1.1000

.5429

.5630

1.1059

.9748

Trinity

.5860

.1000

.6860

.5712

.0975

.6687

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30