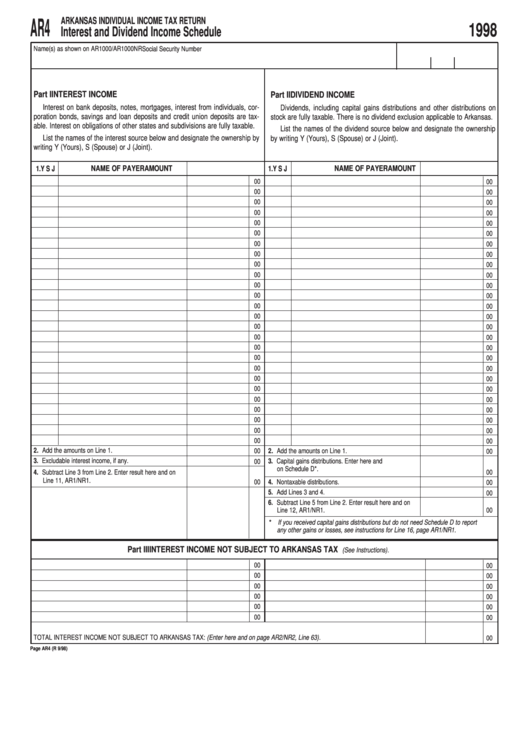

ARKANSAS INDIVIDUAL INCOME TAX RETURN

AR4

1998

Interest and Dividend Income Schedule

Name(s) as shown on AR1000/AR1000NR

Social Security Number

Part I

INTEREST INCOME

Part II

DIVIDEND INCOME

Interest on bank deposits, notes, mortgages, interest from individuals, cor-

Dividends, including capital gains distributions and other distributions on

poration bonds, savings and loan deposits and credit union deposits are tax-

stock are fully taxable. There is no dividend exclusion applicable to Arkansas.

able. Interest on obligations of other states and subdivisions are fully taxable.

List the names of the dividend source below and designate the ownership

List the names of the interest source below and designate the ownership by

by writing Y (Yours), S (Spouse) or J (Joint).

writing Y (Yours), S (Spouse) or J (Joint).

1.Y S J

NAME OF PAYER

AMOUNT

1.Y S J

NAME OF PAYER

AMOUNT

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

2. Add the amounts on Line 1.

2. Add the amounts on Line 1.

00

00

3. Excludable interest income, if any.

3. Capital gains distributions. Enter here and

00

on Schedule D*.

4. Subtract Line 3 from Line 2. Enter result here and on

00

Line 11, AR1/NR1.

4. Nontaxable distributions.

00

00

5. Add Lines 3 and 4.

00

6. Subtract Line 5 from Line 2. Enter result here and on

Line 12, AR1/NR1.

00

* If you received capital gains distributions but do not need Schedule D to report

any other gains or losses, see instructions for Line 16, page AR1/NR1.

Part III

INTEREST INCOME NOT SUBJECT TO ARKANSAS TAX

(See Instructions).

00

00

00

00

00

00

00

00

00

00

00

00

TOTAL INTEREST INCOME NOT SUBJECT TO ARKANSAS TAX: (Enter here and on page AR2/NR2, Line 63). ................................................................

00

Page AR4 (R 9/98)

1

1