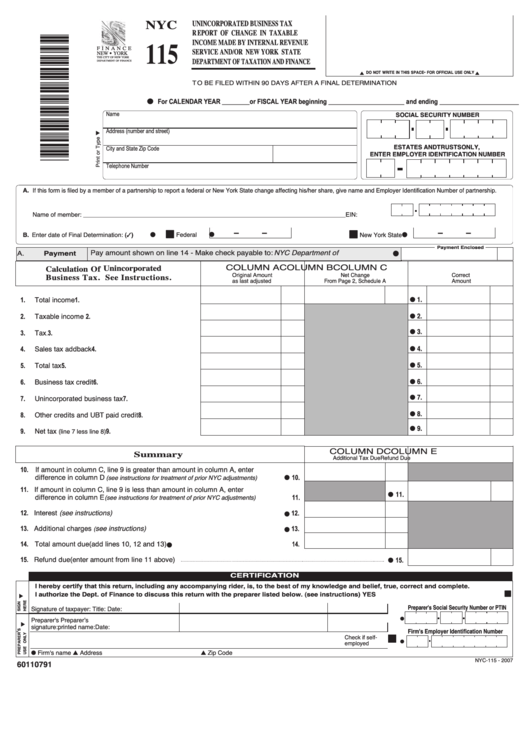

Form Nyc-115 -Unincorporated Business Tax Report Of Change In Taxable Income Made By Internal Revenue Service- 2007

ADVERTISEMENT

115

NYC

UNINCORPORATED BUSINESS TAX

R E P O RT O F C H A N G E I N TA X A B L E

INCOME MADE BY INTERNAL REVENUE

SERVICE AND/OR NEW YORK STATE

F I N A N C E

NEW

YORK

DEPARTMENT OF TAXATION AND FINANCE

G

THE CITY OF NEW YORK

DEPARTMENT OF FINANCE

n y c . g o v / f i n a n c e

-

DO NOT WRITE IN THIS SPACE

FOR OFFICIAL USE ONLY

L

L

T O B E F I L E D W I T H I N 9 0 D AY S A F T E R A F I N A L D E T E R M I N AT I O N

For CALENDAR YEAR ________or FISCAL YEAR beginning ______________________ and ending _______________________

G

SOCIAL SECURITY NUMBER

Name

Address (number and street)

ESTATES AND TRUSTS ONLY,

City and State

Zip Code

ENTER EMPLOYER IDENTIFICATION NUMBER

Telephone Number

A. If this form is filed by a member of a partnership to report a federal or New York State change affecting his/her share, give name and Employer Identification Number of partnership.

Name of member: _____________________________________________________________________________

EIN:

-

-

-

-

I I

I I

B. Enter date of Final Determination: ()

Federal

New York State

G

G

G

G

Pay amount shown on line 14 - Make check payable to: NYC Department of Finance ............

Payment Enclosed

Payment

A.

G

Calculation Of Unincorporated

COLUMN A

COLUMN B

COLUMN C

Business Tax. See Instructions.

Original Amount

Net Change

Correct

as last adjusted

From Page 2, Schedule A

Amount

G 1.

Total income

1.

................................................................................

1.

G 2.

Taxable income

2.

2.

.........................................................................

G 3.

Tax

3.

3.

....................................................................................................

G 4.

Sales tax addback

4.

....................................................................

4.

G 5.

Total tax

5.

5.

.........................................................................................

G 6.

Business tax credit

6.

6.

...................................................................

G 7.

Unincorporated business tax

7.

7.

...............................................

G 8.

Other credits and UBT paid credit

8.

....................................

8.

G 9.

Net tax

(line 7 less line 8)

9.

9.

..........................................................

COLUMN D

COLUMN E

Summary

Additional Tax Due

Refund Due

10. If amount in column C, line 9 is greater than amount in column A, enter

difference in column D

(see instructions for treatment of prior NYC adjustments)

.................

G 10.

11. If amount in column C, line 9 is less than amount in column A, enter

G 11.

difference in column E

(see instructions for treatment of prior NYC adjustments)

.......................

11.

12. Interest (see instructions)

......................................................................................................................

G 12.

see instructions)

13. Additional charges

(

...............................................................................................

G 13.

14. Total amount due (add lines 10, 12 and 13)

G 14.

.................................................................................

15. Refund due (enter amount from line 11 above)

G 15.

C E R T I F I C AT I O N

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) ................................................................YES

I I

Preparer's Social Security Number or PTIN

Signature of taxpayer:

Title:

Date:

Preparer's

Preparerʼs

G

signature:

printed name:

Date:

Firm's Employer Identification Number

I I

Check if self-

employed

G

G Firm's name

L Address

L Zip Code

60110791

NYC-115 - 2007

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2