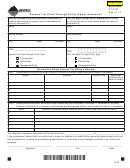

Owner’s Instructions for Montana Schedule K-1 (Forms CLT-4S and PR-1)

General Instructions

►Part 4 – Nonresident Partner/Shareholder Only—Montana

Source Income (Loss)

The Montana Schedule K-1 is required to be provided to all owners. Parts

1 and 2 are completed for all owners. Parts 3, 5 and 6 are completed

If you are a nonresident individual, estate, trust, or pass-through entity,

for all owners only if there is applicable information. Part 4 applies to

your share of the entity’s Montana source income, gains, losses and other

nonresident owners only. The federal Schedule K-1 cannot serve as a

additions to income are shown.

substitute for the Montana Schedule K-1.

4. Guaranteed payments. The guaranteed payments remain with the

Purpose of Montana Schedule K-1

partner receiving the payments as reflected on the federal Schedule K-1.

The portion of the guaranteed payments that represent Montana source

Montana Schedule K-1 shows information about your share of income,

income are reported on this line.

gains, losses, deductions, credits and other items from an S corporation,

►Part 5 – Supplemental Information

a partnership, or a limited liability company (LLC) that is treated as an S

corporation or partnership for income tax purposes. If applicable, your

Supplemental information which could result in adjustments to the

share of “Montana source income” is listed. You may need this information

Montana tax return is listed.

to complete the appropriate Montana tax return.

1. Montana composite income tax paid on behalf of partner/

Partnership or corporation partner/shareholder. If you are a

shareholder. If applicable, the amount shown on this line is the amount

corporation, partnership, or a limited liability company treated like a

of Montana composite income tax paid on your behalf by the entity. If

corporation or partnership, the Montana Schedule K-1 shows your share

you made this election, you are not required to file your own Montana tax

of the entity’s Montana statutory adjustments or tax credits that may affect

return. This is for your information only.

the preparation of your Montana tax return.

2. Montana income tax withheld on behalf of partner/shareholder. The

Resident individual, estate, or trust partner/shareholder. If you are a

entity was required to withhold Montana income tax for those nonresident

Montana resident individual, estate, or trust, you report to Montana your

owners who did not file a consent agreement (Form PT-AGR) or statement

entire share of the entity’s income, gains, losses, and deductions included

(Form PT-STM) and did not elect to participate in a composite return.

in your federal taxable income. The Montana Schedule K-1 shows your

3. Montana mineral royalty tax withheld. If mineral rights are held by

share of the entity’s Montana statutory adjustments or tax credits that may

a partnership or S corporation in which you have an ownership interest,

affect the preparation of your Montana tax return.

the royalty payments made to the owners may be subject to withholding

Nonresident individual, estate, or trust partner/shareholder. If you are

if certain thresholds are met. If the partnership or S corporation attributed

a nonresident individual, estate, or trust, the amount of your share of the

the withheld mineral royalty tax to you, the amount attributed is listed.

entity’s income, gains, losses, and deductions that are apportioned and

This withholding should not be confused with the amounts deducted from

allocated to Montana based on the entity’s activity in Montana is used to

royalty payments for production taxes.

determine your Montana tax liability. These items are shown in Part 4 of

4. Separately stated allocable nonbusiness items. All amounts that are

the Montana Schedule K-1. Unless you are a nonresident individual who

allocable to Montana from nonbusiness activities are reported on this line.

elected to participate in a composite return filed on your behalf by the

entity, you need to file a Montana tax return to determine your tax liability.

►Part 6 – Montana Tax Credits and Recapture (If Applicable)

Composite return election. If you are a nonresident individual, a foreign

Any credit claimed by a partnership or S corporation has to be attributable

C corporation, or a pass-through entity who elected to participate in a

to its owners generally using the same proportion that is used to report

composite return filed on your behalf by the entity, you are not required to

your share of that entity’s income or loss for Montana income tax

file a Montana tax return. If this applies to you, you received the Montana

purposes. The tax credits cannot be taken as a credit against composite

Schedule K-1 to show your share of tax items the entity reported and the

tax. The form includes the most common tax credits along with space to

composite tax paid on your behalf.

provide information about any other tax credit or recapture amount.

Amended Schedule K-1 (Forms CLT-4S and PR-1). If you received an

1-1a. Insure Montana small business health insurance credit. If

amended Montana Schedule K-1 from the entity, and you previously filed a

the entity received a tax credit for the Insure Montana small business

Montana tax return, you may need to file an amended Montana tax return

health insurance program, the amount entered on line 1a is the portion

to report the changes in income, gains, losses and deductions.

of the premiums paid for these policies which was reported on Montana

Schedule K-1 in Part 3 as an other addition to income on line 3.

Montana Schedule K-1, Parts 3-6

2. Contractor’s gross receipts tax credit. If the entity received a tax

►Part 3 – All Partners/Shareholders – Montana Adjustments

credit for contractor’s gross receipts, the CGR Account ID will be entered

A-B. Montana Additions and Deductions

into the space provided and the amount entered on line 2 is your portion

of the credit. If credit amounts from multiple CGR accounts are passing

To compute Montana income taxable to pass-through entity owners,

through to you, a schedule included with your K-1 will identify how much

certain items have to be added to income or deducted from income.

credit passes through to you from each CGR account.

The amounts listed are the owner’s share of Montana additions and

deductions from corresponding lines on the Schedules A and B filed with

4. Other credit/recapture information. Some tax credits have provisions

the business’s information tax return (PR-1 or CLT-4S).

requiring a recapture of the tax benefit you received in an earlier tax year

(if you do not meet certain requirements in subsequent tax years).

1

1 2

2 3

3 4

4