Form Ct-50 Draft - Combined Filer Group Listing - 2012

ADVERTISEMENT

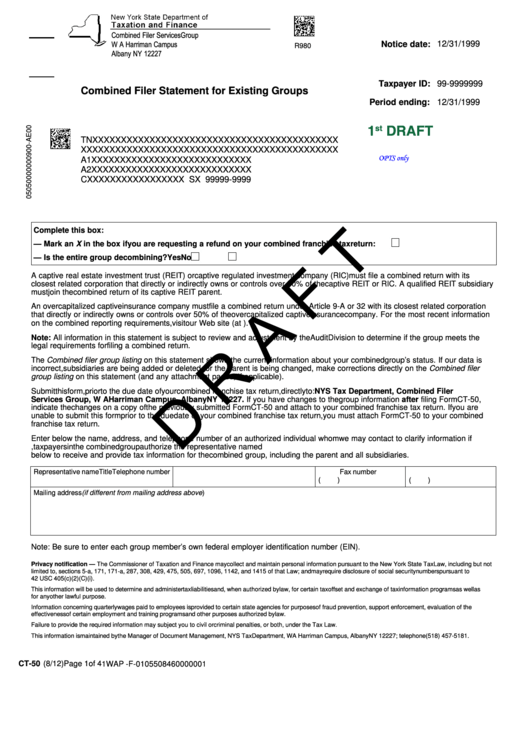

Notice date:

12/31/1999

R980

Taxpayer ID:

99-9999999

Combined Filer Statement for Existing Groups

Period ending:

12/31/1999

1

DRAFT

st

TNXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

OPTS only

A1XXXXXXXXXXXXXXXXXXXXXXXXXXXX

A2XXXXXXXXXXXXXXXXXXXXXXXXXXXX

CXXXXXXXXXXXXXXXXX SX 99999-9999

Complete this box:

— Mark an X in the box if you are requesting a refund on your combined franchise tax return:

— Is the entire group decombining? Yes

No

A captive real estate investment trust (REIT) or captive regulated investment company (RIC) must file a combined return with its

closest related corporation that directly or indirectly owns or controls over 50% of the captive REIT or RIC. A qualified REIT subsidiary

must join the combined return of its captive REIT parent.

An overcapitalized captive insurance company must file a combined return under Article 9-A or 32 with its closest related corporation

that directly or indirectly owns or controls over 50% of the overcapitalized captive insurance company. For the most recent information

on the combined reporting requirements, visit our Web site (at ).

Note: All information in this statement is subject to review and adjustment by the Audit Division to determine if the group meets the

legal requirements for filing a combined return.

The Combined filer group listing on this statement shows the current information about your combined group’s status. If our data is

incorrect, subsidiaries are being added or deleted, or the parent is being changed, make corrections directly on the Combined filer

group listing on this statement (and any attachment pages, if applicable).

Submit this form, prior to the due date of your combined franchise tax return, directly to: NYS Tax Department, Combined Filer

Services Group, W A Harriman Campus, Albany NY 12227. If you have changes to the group information after filing Form CT-50,

indicate the changes on a copy of the previously submitted Form CT-50 and attach to your combined franchise tax return. If you are

unable to submit this form prior to the due date of your combined franchise tax return, you must attach Form CT-50 to your combined

franchise tax return.

Enter below the name, address, and telephone number of an authorized individual whom we may contact to clarify information if

needed. By returning this statement for the combined group, taxpayers in the combined group authorize the representative named

below to receive and provide tax information for the combined group, including the parent and all subsidiaries.

Representative name

Title

Telephone number

Fax number

(

)

(

)

Mailing address (if different from mailing address above)

Note: Be sure to enter each group member’s own federal employer identification number (EIN).

Privacy notification — The Commissioner of Taxation and Finance may collect and maintain personal information pursuant to the New York State Tax Law, including but not

limited to, sections 5-a, 171, 171-a, 287, 308, 429, 475, 505, 697, 1096, 1142, and 1415 of that Law; and may require disclosure of social security numbers pursuant to

42 USC 405(c)(2)(C)(i).

This information will be used to determine and administer tax liabilities and, when authorized by law, for certain tax offset and exchange of tax information programs as well as

for any other lawful purpose.

Information concerning quarterly wages paid to employees is provided to certain state agencies for purposes of fraud prevention, support enforcement, evaluation of the

effectiveness of certain employment and training programs and other purposes authorized by law.

Failure to provide the required information may subject you to civil or criminal penalties, or both, under the Tax Law.

This information is maintained by the Manager of Document Management, NYS Tax Department, W A Harriman Campus, Albany NY 12227; telephone (518) 457-5181.

CT-50 (8/12) Page 1 of 4

1WAP -

0550846

F

0000001

- 01

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4