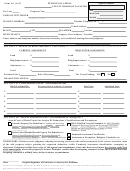

Summary of Actions

Instructions

1. Appeals of property value

Column (5): Enter the number of net accounts sustained.

Column (10): Enter the total assessed value of all net ac-

counts appealed [Column (4)] after adjustment

This number should correspond to the actions

Column (1): Enter the total number of accounts, including

by the board.

shown on the orders. This column should con-

accounts added by Assessor ’s Office. This

tain the number of accounts, not the value of

2. Appeals of value involving unit of property

includes withdrawn petitions, petitions for

the accounts or the number of petitions heard.

which stipulations were filed, and personal

Column (1) Enter the number of net units, by action type

Column (6): Enter the number of net accounts reduced.

property petitions. Include tract property with

(Requested, Recognized). Requested includes

This number should correspond to the actions

residential. Don’t include petitions for waiver

all times the board had to decide whether a

shown on the orders. This column should

unit of property was comprised, whether they

of penalty.

contain the number of accounts, not the value

agreed or not. Recognized includes only those

Column (2): Enter the total number of accounts withdrawn

of the accounts or the number of petitions.

where the board took action on the proposed

by the petitioner. Don’t include petitions for

unit of property.

Column (7): Enter the number of net accounts raised. This

waiver of penalty.

number should correspond to the actions

3. Total number of late filing penalty appeals heard

shown on the orders. This column should

Column (3): Enter the total number of accounts for which a

Column (1) Enter the number of net appeals filed for the

contain the number of accounts, not the value

signed stipulation is filed under ORS 308.242

reduction or waiver of the late filing penalty.

of the accounts or the number of petitions.

with the clerk prior to the time the board con-

Include all appeals, whether appeal is dis-

venes. No order is issued by the board for these

Column (8): Enter the number of net accounts dismissed.

missed or the penalty is waived or reduced.

stipulations.

Don’t include withdrawn petitions; these

should be shown in column 2.

Column (4): Enter the net accounts appealed. This column

should equal column (1) minus columns (2)

Column (9): Enter the total assessed value of all net

and (3). These are the accounts for which an

accounts appealed [Column (4)] before adjust-

order is issued.

ment by the board.

The Summary of Actions is required by OAR 150-309-0260 and must be filed with the Department of Revenue within 45 days after the board adjourns.

150-303-055

(Rev. 08-17)

32

1

1 2

2