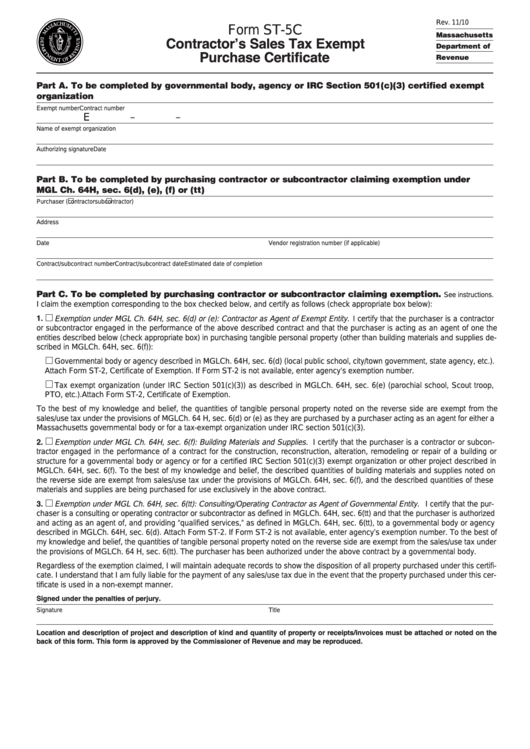

Rev. 11/10

Form ST-5C

Massachusetts

Contractor’s Sales Tax Exempt

Department of

Purchase Certificate

Revenue

Part A. To be completed by governmental body, agency or IRC Section 501(c)(3) certified exempt

organization

Exempt number

Contract number

E

–

–

Name of exempt organization

Authorizing signature

Date

Part B. To be completed by purchasing contractor or subcontractor claiming exemption under

MGL Ch. 64H, sec. 6(d), (e), (f) or (tt)

Purchaser (

contractor

subcontractor)

Address

Date

Vendor registration number (if applicable)

Contract/subcontract number

Contract/subcontract date

Estimated date of completion

Part C. To be completed by purchasing contractor or subcontractor claiming exemption.

See instructions.

I claim the exemption corresponding to the box checked below, and certify as follows (check appropriate box below):

1.

Exemption under MGL Ch. 64H, sec. 6(d) or (e): Contractor as Agent of Exempt Entity. I certify that the purchaser is a contractor

or subcontractor engaged in the performance of the above described contract and that the purchaser is acting as an agent of one the

entities described below (check appropriate box) in purchasing tangible personal property (other than building materials and supplies de-

scribed in MGL Ch. 64H, sec. 6(f)):

Governmental body or agency described in MGL Ch. 64H, sec. 6(d) (local public school, city/town government, state agency, etc.).

Attach Form ST-2, Certificate of Exemption. If Form ST-2 is not available, enter agency’s exemption number.

Tax exempt organization (under IRC Section 501(c)(3)) as described in MGL Ch. 64H, sec. 6(e) (parochial school, Scout troop,

PTO, etc.). Attach Form ST-2, Certificate of Exemption.

To the best of my knowledge and belief, the quantities of tangible personal property noted on the reverse side are exempt from the

sales/use tax under the provisions of MGL Ch. 64 H, sec. 6(d) or (e) as they are purchased by a purchaser acting as an agent for either a

Massachusetts governmental body or for a tax-exempt organization under IRC section 501(c)(3).

2.

Exemption under MGL Ch. 64H, sec. 6(f): Building Materials and Supplies. I certify that the purchaser is a contractor or subcon-

tractor engaged in the performance of a contract for the construction, reconstruction, alteration, remodeling or repair of a building or

structure for a governmental body or agency or for a certified IRC Section 501(c)(3) exempt organization or other project described in

MGL Ch. 64H, sec. 6(f). To the best of my knowledge and belief, the described quantities of building materials and supplies noted on

the reverse side are exempt from sales/use tax under the provisions of MGL Ch. 64H, sec. 6(f), and the described quantities of these

materials and supplies are being purchased for use exclusively in the above contract.

Exemption under MGL Ch. 64H, sec. 6(tt): Consulting/Operating Contractor as Agent of Governmental Entity. I certify that the pur-

3.

chaser is a consulting or operating contractor or subcontractor as defined in MGL Ch. 64H, sec. 6(tt) and that the purchaser is authorized

and acting as an agent of, and providing “qualified services,” as defined in MGL Ch. 64H, sec. 6(tt), to a governmental body or agency

described in MGL Ch. 64H, sec. 6(d). Attach Form ST-2. If Form ST-2 is not available, enter agency’s exemption number. To the best of

my knowledge and belief, the quantities of tangible personal property noted on the reverse side are exempt from the sales/use tax under

the provisions of MGL Ch. 64 H, sec. 6(tt). The purchaser has been authorized under the above contract by a governmental body.

Regardless of the exemption claimed, I will maintain adequate records to show the disposition of all property purchased under this certifi-

cate. I understand that I am fully liable for the payment of any sales/use tax due in the event that the property purchased under this cer-

tificate is used in a non-exempt manner.

Signed under the penalties of perjury.

Signature

Title

Location and description of project and description of kind and quantity of property or receipts/invoices must be attached or noted on the

back of this form. This form is approved by the Commissioner of Revenue and may be reproduced.

1

1 2

2 3

3 4

4