Demonstration Of Filing State And Local Sales And Use Taxes (Form 10 - Single Location) - Nebraska Department Of Revenue Page 18

ADVERTISEMENT

D

E

M

O

N

S

T

R

A

•

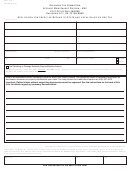

The program defaults to enter the Amount Subject to Local Tax,

T

and then calculates the tax automatically.

•

Be sure to enter the amounts of sales in the correct columns –

I

notice that the Amount Subject to Local Use Tax (net taxable

sales for each jurisdiction) is on the left side, and the Amount

O

Subject to Local Sales Tax is on the right.

N

8/7/2017

NebFile for Business – Single Location

18

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42