Demonstration Of Filing State And Local Sales And Use Taxes (Form 10 - Single Location) - Nebraska Department Of Revenue Page 30

ADVERTISEMENT

D

E

M

O

N

S

T

R

•

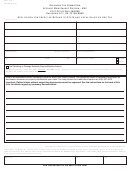

Enter your total gross sales and services on line 1.

•

Enter the total Amount Subject to state and local Sales Tax on line 2. The

A

line 3 amount is automatically calculated.

T

•

From Schedule I, multiply the total Amount Subject to state Use Tax by 0.55

and enter the result on line 4.

I

•

You have not submitted your return at this time. You will have an opportunity

to print the completed Form 10 after receiving your reference number.

O

•

When you are finished, click on the “Save/Next” button.

N

8/7/2017

NebFile for Business – Single Location

30

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42