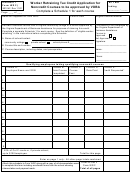

Instructions For Form Wrc - Worker Retraining Tax Credit Application Page 2

ADVERTISEMENT

“Noncredit Courses” include, but are not limited to:

Part II - Credit Based On Noncredit Courses From A

< specific job-related skills/studies,

Community College Or Private School

< computer training due to process or equipment change of

Credit will be granted for retraining through noncredit courses

entry-level computer skills (ongoing computer software

upgrades are not included),

approved by the Virginia Department of Business Assistance.

< continuous improvements such as team building and quality

training,

Complete Schedule 1 (Form WRC), using the instructions below,

< management and supervisory training,

then enter the total number of courses and total credit requested

< safety and environmental training programs, and

for training costs for approved courses in the space provided.

< credit or noncredit approved apprenticeship courses.

Complete a separate Schedule 1 for each course for which the

credit is requested.

“Qualified Employee” means an employee who works in a full-

Schedule 1 (Form WRC) Instructions

time position requiring a minimum of 1,680 hours in the normal

Enter the course information requested, then list qualifying

year of the employer’ s operation and standard fringe benefits are

offered to the employee. Employees eligible to take credit or non-

employees for whom employee retraining was provided through

credit courses undertaken through a registered apprenticeship

noncredit courses from a Virginia community college or private

school. See the definitions listed in these instructions before

agreement must be employed in a full time position requiring a

completing this schedule to ensure that the training costs and

minimum of 1,924 hours in the normal year of the employer’ s

operation unless otherwise approved by the Virginia

employees listed qualify. If additional space is needed, attach a

Apprenticeship Council. A Qualified Employee shall not be (i) a

separate page.

spouse; child; grandchild; parent or sibling of an employer; or in

Use the following instructions when entering information on

the case of a corporation, an individual that owns, directly or

indirectly, five percent or more of the corporation’ s stock.

qualifying full-time employees.

Employees in seasonal or temporary positions are not qualified

Col. A:

Enter the name and social security number of each

for this program.

qualifying employee.

Col. B:

Enter the date that the employee was hired.

“Retraining” means an upgrade in training for existing

employees, which is identified as essential to the production or

Col. C:

Enter the name of the qualifying non-credit course and

the date that training began.

distribution of a product, rendering services or retraining

Col. D:

Enter 30% of the qualifying training cost incurred for

provided through an apprenticeship agreement approved by the

noncredit courses at a community college, or, if training

Virginia Apprenticeship Council.

was from a private school, enter the qualifying training

cost for noncredit courses, up to $100. Note that the

“Standard Fringe Benefits” means the benefits that a particular

maximum credit involving training from a private

employer offers to its full-time employees.

school is $100 per employee, regardless of the number

of courses. Check the box if training was from a private

“Training Costs” means instruction, instructional materials,

school. Attach a schedule showing training cost

facilities fees, and other costs determined to be necessary to the

computation.

delivery of the training. Trainee wages and curriculum

Col. E:

Approved cost: This column will be completed for you

development costs are not covered.

during processing. Leave it blank.

I

F

C

F

WRC

NSTRUCTIONS

OR

OMPLETING

ORM

Part III - Credit Based On Apprenticeship Programs

When completing Form WRC, remember that claiming the credit

Credit will be granted for apprenticeship programs (approved by

is a multi-step process. Complete Form WRC and the required

the Virginia Apprenticeship Council through the Virginia

schedules using the definitions listed earlier in these instructions.

Department of Labor and Industry) which meet the qualifications

To assist you in completing Schedules 1 and 2 correctly, review

for this credit. See the definitions provided earlier in these

these definitions: Eligible worker retraining, qualified employee,

instructions, before completing this section.

noncredit courses, retraining, standard fringe benefits and training

costs.

Complete Schedule 2 (Form WRC) using the instructions below,

then enter each program name and the total cost and total credit

P

I - D

O

B

A

ART

ESCRIPTION

F

USINESS

CTIVITIES

requested in the space provided. Complete a separate schedule

for each apprenticeship program for which the worker retraining

Enter the Standard Industrial Code (SIC) of the business and

tax credit is requested.

describe its principle activity of the business.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3