Instructions For Form Wrc - Worker Retraining Tax Credit Application Page 3

ADVERTISEMENT

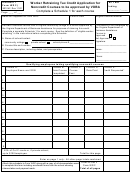

Schedule 2 (Form WRC) Instructions

later than May 15. Employers will be notified by June 30 as to

Enter the name of the apprenticeship program and describe the

the applicable credit. After notification, claim the credit on the

program, then use the instructions on Schedule 2 (Form WRC) to

tax return the same as any other credit.

list each employee for whom retraining was provided through an

approved apprenticeship program and enter the information

In the event that requests for worker retraining credits exceed the

requested concerning that training. See the definitions listed in

annual fiscal limitation of $2,500,000, each employer shall be

these instructions before completing this schedule to ensure that

granted a pro rata amount as determined by the Department of

the training costs and employees listed qualify for the credit. If

Taxation.

additional space is needed, attach a separate page.

IMPORTANT: Taxpayers who will not receive the final

W

W

T

F

F

WRC

HEN AND

HERE

O

ILE

ORM

certification of their credits prior to the due date of the state tax

return on which the credit will be claimed must file the

File the 2000 Form WRC no later than April 1, 2001, in order

appropriate return extension request or file their income tax

for the qualification process to be completed. Forms received

return by the due date, then amend their return after receiving

after that date may not be processed and credit may not be

credit certification from the Department of Taxation.

approved.

If applying for the worker retraining credit based on the noncredit

course alone or on both the noncredit course and an

P

-T

E

ASS

HROUGH

NTITIES

apprenticeship program, file Form WRC with all required

attachments (listed below) to:

The Virginia Department of Taxation will issue a credit certificate

specifying the amount of credit authorized to each partnership, S

Worker Retraining Tax Credit Application

corporation or limited liability company qualifying to claim a

Virginia Department of Business Assistance

portion of this credit.

P. O. Box 446

Richmond, Virginia 23218-0446

Each pass-through entity must attach to their application a

Schedule listing the name, address, social security or FEIN

If applying for the worker retraining credit based only on the

number, and proportion of ownership/interest that each of their

apprenticeship program, file Form WRC with all required

partners, ownership or interest has in the business.

attachments (listed below) to:

After the credit is granted, the pass-through entity must distribute

Capped Credit Unit

this credit to its partners, shareholders and members. Each

Virginia Department of Taxation

member must be provided a copy of the credit certificate and a

P. O. Box 715

statement specifying the amount and percentage of the credit

Richmond, Virginia 23218-0715

distributed. The taxpayer claiming the credit must attach a copy

of the certificate and the statement to their tax return in order to

obtain the credit.

W

T

A

F

WRC

HAT

O

TTACH TO

ORM

If Schedule 1(Form WRC) was completed, attach a copy of the

W

T

G

H

HERE

O

ET

ELP

documentation used in completing Schedule 1, including

enrollment forms from the school/college showing the courses

Write the Virginia Department of Taxation, P. O. Box 715,

taken and payment by the employer.

Richmond, VA 23220-0715 or call (804) 367-2992. To order

forms, call 1-888 268-2829 (toll free outside the Richmond,

If Schedule 2 (Form WRC) was completed, attach a schedule

Virginia calling area), (804) 236-2760 or (804) 236-2761. If

showing computation of the training costs for each employee and

you have Internet access, connect to

a complete copy of the signed apprenticeship program agreement,

as approved by the Virginia Apprenticeship Council (Virginia

for most Virginia tax forms and additional tax information.

Department of Labor and Industry). Also include a list identifying

Forms are also available from the office of your local

the credit and noncredit courses included in the training program,

Commissioner of the Revenue, Director of Finance or Director of

indicating for each the training source (Virginia community

Tax Administration.

college or private school) and cost.

Virginia Tax Bulletin 99-4, dated April 4, 1999, provides

W

T

E

A

F

F

WRC

HAT

O

XPECT

FTER

ILING

ORM

additional information on the worker retraining credit and

how the credit applies. To obtain this bulletin, see “Where

Applications will be reviewed by the Virginia Department of

To Get Help” above.

Business Assistance and/or the Virginia Department of

Taxation for completeness. Employers will be notified of any

errors by May 1 and must respond to any unresolved issues no

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3