Form Dr 21s - Application For Extension Of Time To File Colorado Severance Tax Return - 2004

ADVERTISEMENT

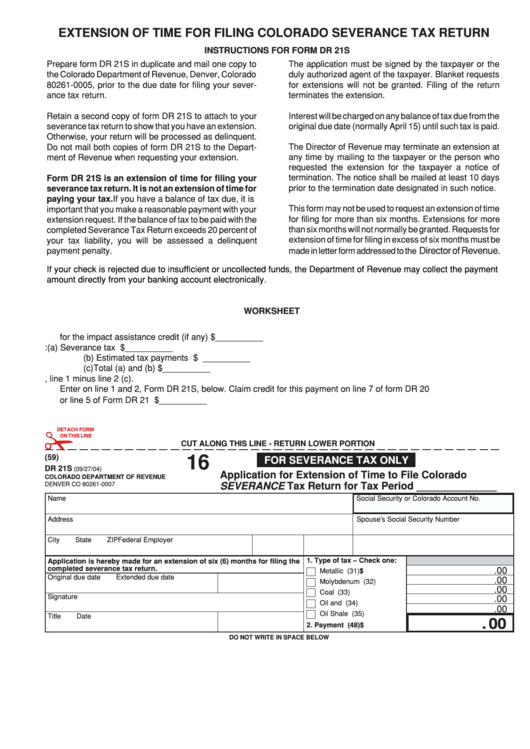

EXTENSION OF TIME FOR FILING COLORADO SEVERANCE TAX RETURN

INSTRUCTIONS FOR FORM DR 21S

Prepare form DR 21S in duplicate and mail one copy to

The application must be signed by the taxpayer or the

the Colorado Department of Revenue, Denver, Colorado

duly authorized agent of the taxpayer. Blanket requests

80261-0005, prior to the due date for filing your sever-

for extensions will not be granted. Filing of the return

ance tax return.

terminates the extension.

Retain a second copy of form DR 21S to attach to your

Interest will be charged on any balance of tax due from the

severance tax return to show that you have an extension.

original due date (normally April 15) until such tax is paid.

Otherwise, your return will be processed as delinquent.

The Director of Revenue may terminate an extension at

Do not mail both copies of form DR 21S to the Depart-

any time by mailing to the taxpayer or the person who

ment of Revenue when requesting your extension.

requested the extension for the taxpayer a notice of

termination. The notice shall be mailed at least 10 days

Form DR 21S is an extension of time for filing your

prior to the termination date designated in such notice.

severance tax return. It is not an extension of time for

paying your tax. If you have a balance of tax due, it is

This form may not be used to request an extension of time

important that you make a reasonable payment with your

for filing for more than six months. Extensions for more

extension request. If the balance of tax to be paid with the

than six months will not normally be granted. Requests for

completed Severance Tax Return exceeds 20 percent of

extension of time for filing in excess of six months must be

your tax liability, you will be assessed a delinquent

Director of Revenue.

payment penalty.

made in letter form addressed to the

If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment

amount directly from your banking account electronically.

WORKSHEET

1. Tentative amount of tax for the taxable year after reduction

for the impact assistance credit (if any) .............................................................................................. $ __________

2. Less: (a) Severance tax withheld ....................................................................................................... $ __________

(b) Estimated tax payments ...................................................................................................... $ __________

(c) Total (a) and (b) ................................................................................................................... $ __________

3. Balance to be remitted with this request for extension, line 1 minus line 2 (c).

Enter on line 1 and 2, Form DR 21S, below. Claim credit for this payment on line 7 of form DR 20

or line 5 of Form DR 21 ...................................................................................................................... $ __________

DETACH FORM

ON THIS LINE

CUT ALONG THIS LINE - RETURN LOWER PORTION

(59)

16

FOR SEVERANCE TAX ONLY

DR 21S

(09/27/04)

Application for Extension of Time to File Colorado

COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0007

SEVERANCE Tax Return for Tax Period ______________

Name

Social Security or Colorado Account No.

Address

Spouse's Social Security Number

City

State

ZIP

Federal Employer I.D. Number

1. Type of tax – Check one:

Application is hereby made for an extension of six (6) months for filing the

completed severance tax return.

.00

Metallic Minerals ....... (31)

$

Original due date

Extended due date

.00

Molybdenum Ore ...... (32)

.00

Coal .......................... (33)

Signature

.00

Oil and Gas .............. (34)

.00

Oil Shale Facility ....... (35)

Title

Date

. 0 0

2. Payment due .............. (48)

$

DO NOT WRITE IN SPACE BELOW

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1