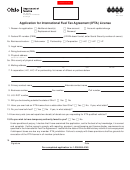

Form Ohif-1 - Application For International Fuel Tax Agreement (Ifta) License Page 2

ADVERTISEMENT

Excise and Motor Fuel Division

P.O. Box 530

Columbus, OH 43216-0530

(614) 466-3921

Fax (614) 728-8085

Application for International Fuel Tax Agreement (IFTA) License Instructions

Special Instructions: (Please print or type when completing form)

1. List federal employer identification number if a corporation, LLC or LLP. Enter social security number if a partnership or

individual.

2. Print the legal name of the business (partnership, limited liability company or corporate name). If the business is a sole

proprietorship, indicate complete name (last, first and middle name).

3. Print the trade name or registered business name (DBA) if different from the legal business name.

4. Print the physical location of the business (P.O. boxes are not acceptable). The address where business is actually

located.

5. Print the mailing address of the business if different from line 4. Only complete if different from the business address

listed above.

6. List the name of a contact person should there be any questions concerning your application and/or tax returns.

7. Print the Ohio county in which your business is located.

8. Please check appropriate box to indicate type of ownership.

9. If corporation, LLC, LLP, LP or partnership, please list the name, address and social security number for each officer or

partner. Use a separate sheet if more space is needed.

10. If you have an Internet e-mail address, please print it on this line.

11. Telephone and fax number of business.

12. If you have registered with the Federal Motor Carrier Safety Administration (FMCSA), enter the U.S. D.O.T. number that

has been assigned to you.

13. IRP (International Registration Plan – apportioned tag) account number and IRP base state.

14. through 16. Check “yes” or “no” and indicate the state or account number where appropriate.

17. List each state in which you maintain bulk fuel storage.

18. Enter requested number of sets of decals. Order only as many as needed. You are required to account for every decal

issued to you for the current year and the previous three years. Decals will be mailed to the address shown on line 4 (or

line 5, if completed) within two working days of receipt of this application. Please mail the form to the above address or

fax to the number shown above.

19. and 20. – OPTIONAL – Should be completed only if you are requesting a temporary authority. If you need immediate

authority to run, check “yes” to have temporary authority faxed to you at the fax number shown on line 11. Upon receipt

of validated temporary authority, enter the vehicle identification number in the space provided on line 20. Note: You may

reproduce a validated temporary authority for up to the number of decals requested on line 18. A temporary authority is

valid for 30 days.

21. Signature – Every licensee shall file quarterly tax returns and maintain records to support information on the tax returns.

The tax returns are due on the last day of the month following the calendar quarter. The records must be maintained for

a period of four years from the due date of the return. The records must be available to the Ohio Department of Taxation

upon request.

Federal Privacy Act

Because we are requesting your social security account

needed for the Tax Commissioner to administer this tax.

number, the Federal Privacy Act of 1974 requires us to inform

Failure to supply any information requested on a tax form

you that giving us your social security number is mandatory.

prescribed by the Tax Commissioner may result in the denial

Our legal right to ask for this information is supported under

of your license application, if applicable, or the imposition of

the Tax Reform Act of 1986. Your social security number is

penalties for failing to file a complete tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2