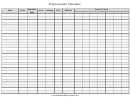

Oregon Depreciation Schedule - 2001 Page 2

ADVERTISEMENT

Instructions for Oregon Depreciation Schedule

O R E G O N

D E PA R T M E N T

For Individuals, Partnerships, Corporations, and Fiduciaries

O F R E V E N U E

Definitions

Useful life. This is the number of years you can reason-

ably expect to use the property in your trade or business,

ACRS. Accelerated Cost Recovery System.

or hold the property to produce income for you.

Amortization. This is an expense similar to depreciation.

One-time adjustment

Amortization allows you to deduct the cost of some in-

tangible property over a certain period of time.

Individuals. The 1996 one-time adjustment was avail-

Basis of property. Generally, the cost of the property is

able to conform Oregon basis of ACRS assets to federal

its basis. For assets first placed in service outside

basis. If you did not make the one-time adjustment, the

Oregon, see later section.

asset will continue to be depreciated differently for fed-

eral than for Oregon and you will continue to make

Depreciation. This is how you deduct the cost of the

modifications on your Oregon return.

property over its useful life. Property you depreciate must

have a useful life of more than one year. Depreciation

If you elected the 1996 one-time adjustment for ACRS

starts when the property is first made available for use

assets, you may carryover any unused subtraction two

(placed in service). You can’t depreciate the cost of land.

years. You may amend your 1997 and 1998 returns

within the statutory period to claim a refund based on

Intangible property. This is personal property that has

the carryover of the subtraction. Any carryover of the

a value but cannot be seen or touched. Examples of in-

subtraction not fully absorbed in the second carryover

tangibles include goodwill, franchises, patents, and

year will be lost.

trademarks. Internal Revenue Code (IRC) Section 197

allows certain intangibles to be amortized over 15 years.

Corporations. The 1996 one-time adjustment was man-

datory. No further modifications to depreciation are al-

MACRS. Modified Accelerated Cost Recovery System.

lowed for ACRS assets.

Nonresidential real property. This is property held for

the production of income or property used in a trade or

Assets first placed in service outside Oregon

business. This is IRC Section 1250 real property that is

not (1) residential rental property, or (2) property with

Did you bring an asset into Oregon after it was first

a class life of less than 27.5 years.

placed in service outside Oregon? If so, use the depre-

ciation method available for the year the asset was first

Personal property. Property which isn’t real property is

placed in service outside Oregon.

generally personal property. Machinery, equipment,

tools, and vehicles are examples of business personal

The Oregon basis for depreciation is generally the lower

property which can be depreciated.

of the federal unadjusted basis or the fair market value.

The federal unadjusted basis is the original cost before

Real property. This type of property includes land and

any adjustments. Adjustments include: reductions for in-

most buildings or improvements on the land. Land can’t

vestment tax credits, depletion, amortization, or amounts

be depreciated, but buildings and most improvements

expensed under IRC Section 179. The fair market value

can. Apartment complexes and office buildings are ex-

is figured when the asset is brought into Oregon.

amples of depreciable real property.

For assets placed in service before 1985, the useful life

Recovery period. This is the length of time over which

is based on Oregon law in effect at the time the asset was

an asset is depreciated.

originally placed in service and is determined when the

Recovery property. Recovery property is tangible prop-

asset is brought into Oregon. For assets placed in service

erty that can be depreciated. This property must be used

after 1984, the useful life is the remaining original recov-

in a trade or business or be held for the production of

ery period.

income. Recovery property doesn’t include any motion

Example. Jeff has owned a business in Caldwell, ID since

picture film or videotape.

1984 when he placed in service a building purchased for

Salvage value. This is the amount you expect the prop-

$50,000. For federal purposes, the building qualified for

erty to be worth at the end of its useful life (see below).

ACRS depreciation as 18-year real property. On June 1,

Salvage value is figured when you acquire the property.

1998 Jeff bought a light truck for $12,000. For federal, the

Section 179 expense. This allows you to claim some of

truck qualified as 5-year property depreciated under

the cost of certain property as an expense in the year you

MACRS. On January 1, 2001 Jeff moved to Ontario, Or-

acquire it, rather than recovering the entire cost over the

egon. Since Jeff “brought” his business assets into Or-

property’s recovery period. Oregon allows the same

egon, he had to figure his Oregon basis in order to

amount as federal law for the Section 179 expense.

depreciate the assets for Oregon.

2

150-101-025 (Rev. 9-01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4