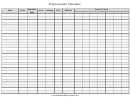

Oregon Depreciation Schedule - 2001 Page 4

ADVERTISEMENT

Taxpayer assistance

Telephone

503-378-4988

Salem ............................................................

Internet

1-800-356-4222

Toll-free within Oregon ...........................

If you have a touch-tone telephone call our 24-hour voice

response system at one of the numbers above to:

The Department of Revenue Web site is a

• Hear recorded tax information

quick and easy way to download forms

• Order tax forms.

and information circulars, get up-to-the-

• Check on the status of your 2001

minute tax information, and learn about

personal income tax refund

electronic filing.

(beginning February 1).

Call one of the numbers above for help from a represen-

Printed information (free)

tative during the following hours:

Monday, Tuesday, Thursday, Friday ............... 7:30

.

.–5:10

.

.

A

M

P

M

Income tax booklets are available at many post offices,

Wednesday ............................................................ 10:00

.

.–5:10

.

.

A

M

P

M

banks, and libraries. Or write to: Forms, Oregon

Closed on holidays.

Department of Revenue, PO Box 14999, Salem OR 97309-

April 1–April 15, Monday–Friday ..................... 7:00

.

.–7:00

.

.

A

M

P

M

Wait times may be 20 minutes or more.

0990. Use the order form below to order other printed tax

information.

TTY (hearing or speech impaired only). These numbers

are answered by machine only and are not for voice use.

The toll-free number within Oregon is 1-800-886-7204. In

Salem, the number is 503-945-8617.

(Check individual boxes to order. Clip on the dotted line, then mail in

the entire list with your return address. Most of these forms and

¿Habla español? Línea de mensaje. Las personas que

circulars are also available on the Internet.)

necesitan asistencia en español pueden dejar un mensaje.

Amended Form 40X and instructions ................ 150-101-046

El número disponible todo el año en Salem es 503-945-8618.

Computing Interest on Tax You Owe .................. 150-800-691

A message line is available all year for those who need as-

Credit for Income Taxes Paid to Another State ........ 150-101-646

Depreciation schedule ........................................... 150-101-025

sistance in Spanish. The number in Salem is 503-945-8618.

Elderly Rental Assistance booklet ...................... 150-545-002

Estimated Tax circular ............................................ 150-101-648

Correspondence

Estimated Tax coupons ...................................... 150-101-026-2

Estimated Tax instructions ................................... 150-101-026

Write us at 955 Center St NE, Salem OR 97301-

Home Care of a Person Age 60 or Older .......... 150-101-653

2555. Include your Social Security number and a

Interest and Dividends on U.S. Bonds and Notes .... 150-101-615

daytime telephone number for faster service.

Interstate Transportation Wages ........................ 150-101-601

Limit on Itemized Deductions ............................. 150-101-611

Long-Term Care Insurance Premiums Credit ........... 150-101-622

Field offices

Married Persons Filing Separate Returns ............ 150-101-656

Forms and assistance are available at these offices. Don’t

Military Personnel Filing Information ................. 150-101-657

Oregon Income Tax Withholding:

send your return to these addresses.

Some Special Cases .............................................. 150-206-643

Bend .............. 951 SW Simpson Dr, Suite 100

Political Contributions ............................................ 150-101-662

Eugene .......... 1600 Valley River Dr, Suite 310

Record Keeping Requirements ........................... 150-101-608

Medford ........ 24 West 6th St

Residential Energy Tax Credit .............................. 150-101-641

Retirement Income .................................................. 150-101-673

Newport ........ 119 NE 4th St, Suite 4

Senior Citizen’s Property Tax Deferral .............. 150-490-675

North Bend ... 3030 Broadway

Underpayment of Oregon Estimated Tax (Form 10) .. 150-101-031

Pendleton ..... 700 SE Emigrant Ave, Suite 310

What To Do if You are Audited ........................... 150-101-607

Portland ........ 800 NE Oregon St, Suite 505

Your Rights as an Oregon Taxpayer .................. 150-800-406

Portland * ...... Federal Building Lobby, 1220 SW Third Ave

List of other printed information:

Salem ............. Revenue Building, 955 Center St NE, Room 135

Forms/Publications Request ............................. 150-800-390

Salem ............. 4275 Commercial St SE, Suite 180

Send to: Forms, Oregon Department of Revenue

Tualatin ......... 6405 SW Rosewood St, Suite A

PO Box 14999, Salem OR 97309-0990

* January 2–April 15: Walk-in help is available from 9:00

.

.– 4:00

.

.,

A

M

P

M

Please print

Monday–Friday, except holidays.

Your name ___________________________________

American with Disabilities Act (ADA)

Address _____________________________________

In compliance with the ADA, this information is available

City _________________________________________

in alternative formats upon request by calling 503-378-4988.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4