Instructions For Form St105 - Sales Tax Exempt Purchases - Footlite Musicals Inc

ADVERTISEMENT

Instructions for Sales Tax

for Sales Tax

Exempt Purchases

Footlite Musicals Inc. is exempt from Indiana Sales Tax. Most vendors will honor this agreement when

Footlite Musicals Inc. is exempt from Indiana Sales Tax. Most vendors will honor this agreement when

Footlite Musicals Inc. is exempt from Indiana Sales Tax. Most vendors will honor this agreement when

provided with Form ST105. Some vendors have a list of exempt vendors and issue their own reference

provided with Form ST105. Some vendors have a list of exempt vendors and issue their own reference

provided with Form ST105. Some vendors have a list of exempt vendors and issue their own reference

number. A list of the primary vendors and their individual processes are described below. If there is an

number. A list of the primary vendors and their individual processes are described below. If there is an

number. A list of the primary vendors and their individual processes are described below. If there is an

organization that you want added to this list, pleas

organization that you want added to this list, please contact Barbara Uggen-Davis, Treasurer at

, Treasurer at

.

For all vendors, it is necessary to know our legal name, address and telephone number: Footlite Musicals

For all vendors, it is necessary to know our legal name, address and telephone number: Footlite Musicals

For all vendors, it is necessary to know our legal name, address and telephone number: Footlite Musicals

Inc. 1847 N. Alabama Street Indianapolis IN 46202 (317) 926

Inc. 1847 N. Alabama Street Indianapolis IN 46202 (317) 926-6630.

IMPORTANT: Prior to ringing up the purchase, notify the cashier that it is a tax

: Prior to ringing up the purchase, notify the cashier that it is a tax-exempt purchase.

exempt purchase.

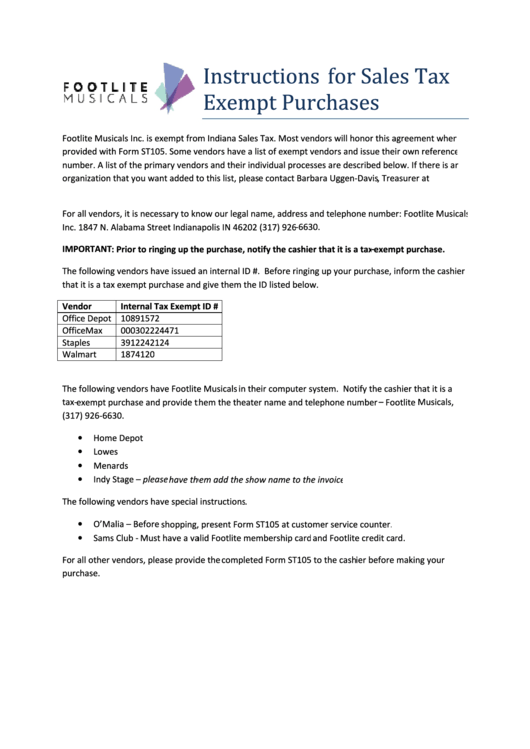

The following vendors have issued an internal ID #. Before ringing up your purchase, inform the cashier

The following vendors have issued an internal ID #. Before ringing up your purchase, inform the cashier

The following vendors have issued an internal ID #. Before ringing up your purchase, inform the cashier

that it is a tax exempt purchase and give them the ID listed below.

that it is a tax exempt purchase and give them the ID listed below.

Vendor

Internal Tax Exempt ID #

Internal Tax Exempt ID #

Office Depot 10891572

OfficeMax

000302224471

Staples

3912242124

Walmart

1874120

The following vendors have Footlite Musicals

The following vendors have Footlite Musicals in their computer system. Notify the cashier that it is a

in their computer system. Notify the cashier that it is a

tax-exempt purchase and provide them the theater name and telephone number

exempt purchase and provide them the theater name and telephone number – Footlite

Footlite Musicals,

(317) 926-6630.

Home Depot

•

Lowes

•

Menards

•

Indy Stage – please have them add the show name to the invoice

have them add the show name to the invoice

•

The following vendors have special instructions

The following vendors have special instructions.

O’Malia – Before shopping, present Form ST105 at customer service counter.

shopping, present Form ST105 at customer service counter.

•

Sams Club - Must have a valid Footlite membership card

Must have a valid Footlite membership card and Footlite credit card

credit card.

•

For all other vendors, please provide the

r all other vendors, please provide the completed Form ST105 to the cashier before making your

ier before making your

purchase.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1