Instructions For Preparation Of Return (S-014)

ADVERTISEMENT

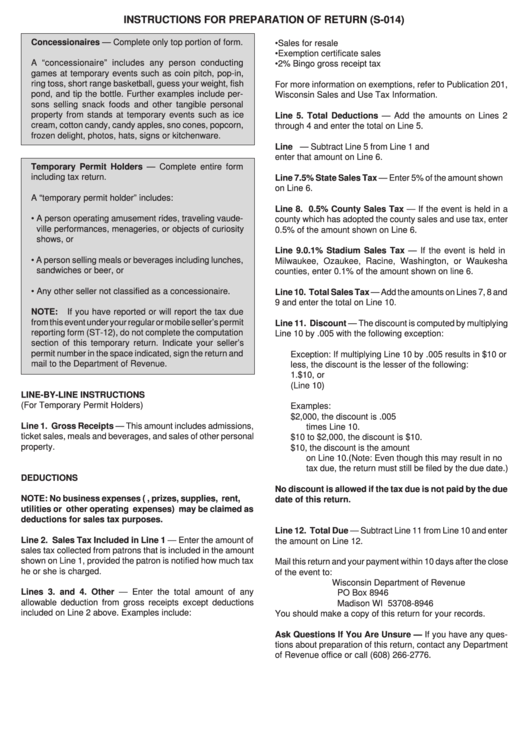

INSTRUCTIONS FOR PREPARATION OF RETURN (S-014)

Concessionaires — Complete only top portion of form.

• Sales for resale

• Exemption certificate sales

A “concessionaire” includes any person conducting

• 2% Bingo gross receipt tax

games at temporary events such as coin pitch, pop-in,

ring toss, short range basketball, guess your weight, fish

For more information on exemptions, refer to Publication 201,

pond, and tip the bottle. Further examples include per-

Wisconsin Sales and Use Tax Information.

sons selling snack foods and other tangible personal

property from stands at temporary events such as ice

Line 5. Total Deductions — Add the amounts on Lines 2

cream, cotton candy, candy apples, sno cones, popcorn,

through 4 and enter the total on Line 5.

frozen delight, photos, hats, signs or kitchenware.

Line 6. Taxable Receipts — Subtract Line 5 from Line 1 and

enter that amount on Line 6.

Temporary Permit Holders — Complete entire form

including tax return.

Line 7. 5% State Sales Tax — Enter 5% of the amount shown

on Line 6.

A “temporary permit holder” includes:

Line 8. 0.5% County Sales Tax — If the event is held in a

• A person operating amusement rides, traveling vaude-

county which has adopted the county sales and use tax, enter

ville performances, menageries, or objects of curiosity

0.5% of the amount shown on Line 6.

shows, or

Line 9. 0.1% Stadium Sales Tax — If the event is held in

• A person selling meals or beverages including lunches,

Milwaukee, Ozaukee, Racine, Washington, or Waukesha

sandwiches or beer, or

counties, enter 0.1% of the amount shown on line 6.

• Any other seller not classified as a concessionaire.

Line 10. Total Sales Tax — Add the amounts on Lines 7, 8 and

9 and enter the total on Line 10.

NOTE:

If you have reported or will report the tax due

from this event under your regular or mobile seller’s permit

Line 11. Discount — The discount is computed by multiplying

reporting form (ST-12), do not complete the computation

Line 10 by .005 with the following exception:

section of this temporary return. Indicate your seller’s

permit number in the space indicated, sign the return and

Exception: If multiplying Line 10 by .005 results in $10 or

mail to the Department of Revenue.

less, the discount is the lesser of the following:

1. $10, or

2. Total Sales Tax (Line 10)

LINE-BY-LINE INSTRUCTIONS

(For Temporary Permit Holders)

Examples:

A. If Line 10 is greater than $2,000, the discount is .005

Line 1. Gross Receipts — This amount includes admissions,

times Line 10.

ticket sales, meals and beverages, and sales of other personal

B. If Line 10 is from $10 to $2,000, the discount is $10.

property.

C. If Line 10 is less than $10, the discount is the amount

on Line 10. (Note: Even though this may result in no

tax due, the return must still be filed by the due date.)

DEDUCTIONS

No discount is allowed if the tax due is not paid by the due

NOTE: No business expenses (e.g., prizes, supplies, rent,

date of this return.

utilities or other operating expenses) may be claimed as

deductions for sales tax purposes.

Line 12. Total Due — Subtract Line 11 from Line 10 and enter

Line 2. Sales Tax Included in Line 1 — Enter the amount of

the amount on Line 12.

sales tax collected from patrons that is included in the amount

shown on Line 1, provided the patron is notified how much tax

Mail this return and your payment within 10 days after the close

he or she is charged.

of the event to:

Wisconsin Department of Revenue

Lines 3. and 4. Other — Enter the total amount of any

PO Box 8946

allowable deduction from gross receipts except deductions

Madison WI 53708-8946

included on Line 2 above. Examples include:

You should make a copy of this return for your records.

Ask Questions If You Are Unsure — If you have any ques-

tions about preparation of this return, contact any Department

of Revenue office or call (608) 266-2776.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1