Instructions For Form Va-16 - Payments Quarterly Reconciliation And Return Of Virginia Income Tax Withheld

ADVERTISEMENT

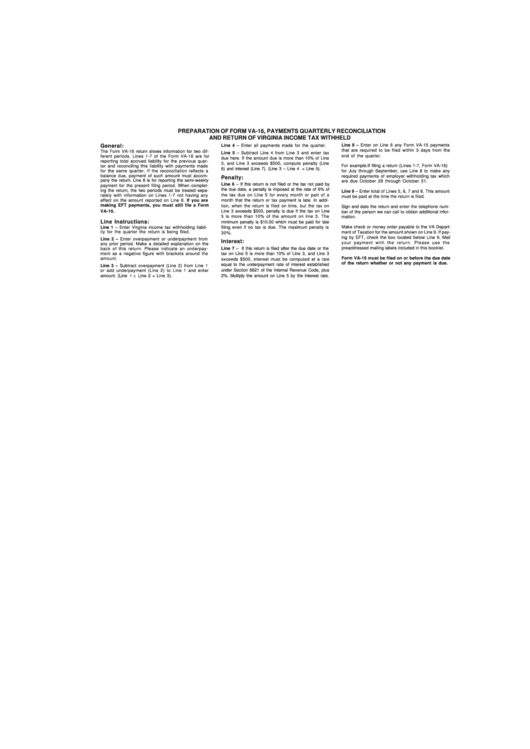

PREPARATION OF FORM VA-16, PAYMENTS QUARTERLY RECONCILIATION

AND RETURN OF VIRGINIA INCOME TAX WITHHELD

Line 8 – Enter on Line 8 any Form VA-15 payments

General:

Line 4 – Enter all payments made for the quarter.

that are required to be filed within 3 days from the

The Form VA-16 return shows information for two dif-

Line 5 – Subtract Line 4 from Line 3 and enter tax

end of the quarter.

ferent periods. Lines 1-7 of the Form VA-16 are for

due here. If the amount due is more than 10% of Line

reporting total accrued liability for the previous quar-

3, and Line 3 exceeds $500, compute penalty (Line

ter and reconciling this liability with payments made

For example: If filing a return (Lines 1-7, Form VA-16)

.

6) and interest (Line 7). (Line 3 – Line 4 = Line 5)

for the same quarter. If the reconciliation reflects a

for July through September, use Line 8 to make any

balance due, payment of such amount must accom-

required payments of employer withholding tax which

Penalty:

pany the return. Line 8 is for reporting the semi-weekly

are due October 28 through October 31.

Line 6 – If this return is not filed or the tax not paid by

payment for the present filing period. When complet-

the due date, a penalty is imposed at the rate of 6% of

ing the return, the two periods must be treated sepa-

Line 9 – Enter total of Lines 5, 6, 7 and 8. This amount

rately with information on Lines 1-7 not having any

the tax due on Line 5 for every month or part of a

must be paid at the time the return is filed.

effect on the amount reported on Line 8. If you are

month that the return or tax payment is late. In addi-

making EFT payments, you must still file a Form

tion, when the return is filed on time, but the tax on

Sign and date the return and enter the telephone num-

VA-16.

Line 3 exceeds $500, penalty is due if the tax on Line

ber of the person we can call to obtain additional infor-

5 is more than 10% of the amount on line 3. The

mation.

Line Instructions:

minimum penalty is $10.00 which must be paid for late

Make check or money order payable to the VA Depart-

Line 1 – Enter Virginia income tax withholding liabil-

filing even if no tax is due. The maximum penalty is

ity for the quarter the return is being filed.

ment of Taxation for the amount shown on Line 9. If pay-

30%.

ing by EFT, check the box located below Line 9. Mail

Line 2 – Enter overpayment or underpayment from

Interest:

your payment with the return. Please use the

any prior period. Make a detailed explanation on the

preaddressed mailing labels included in this booklet.

Line 7 – If this return is filed after the due date or the

back of this return. Please indicate an underpay-

ment as a negative figure with brackets around the

tax on Line 5 is more than 10% of Line 3, and Line 3

Form VA-16 must be filed on or before the due date

amount.

exceeds $500, interest must be computed at a rate

of the return whether or not any payment is due.

equal to the underpayment rate of interest established

Line 3 – Subtract overpayment (Line 2) from Line 1

under Section 6621 of the Internal Revenue Code, plus

or add underpayment (Line 2) to Line 1 and enter

amount. (Line 1

Line 2 = Line 3).

2%. Multiply the amount on Line 5 by the interest rate.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1