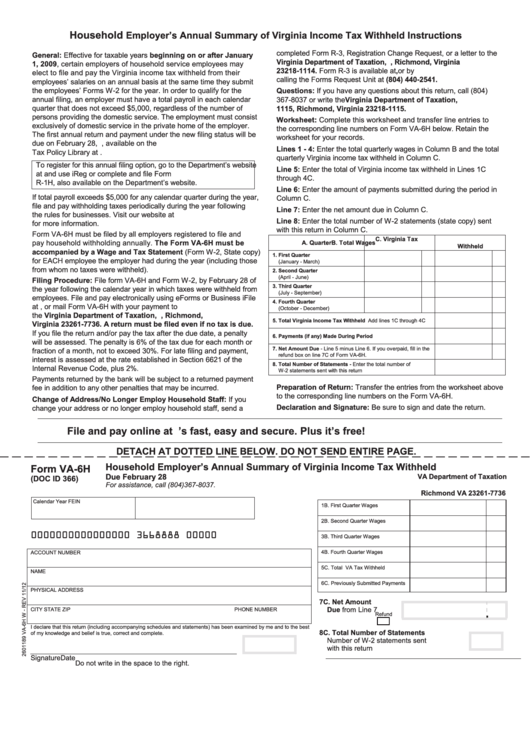

Household

Employer’s Annual Summary of Virginia Income Tax Withheld Instructions

completed Form R-3, Registration Change Request, or a letter to the

General: Effective for taxable years beginning on or after January

Virginia Department of Taxation, P.O. Box 1114, Richmond, Virginia

1, 2009, certain employers of household service employees may

23218-1114. Form R-3 is available at , or by

elect to file and pay the Virginia income tax withheld from their

calling the Forms Request Unit at (804) 440-2541.

employees’ salaries on an annual basis at the same time they submit

the employees’ Forms W-2 for the year. In order to qualify for the

Questions: If you have any questions about this return, call (804)

annual filing, an employer must have a total payroll in each calendar

367-8037 or write the Virginia Department of Taxation, P.O. Box

quarter that does not exceed $5,000, regardless of the number of

1115, Richmond, Virginia 23218-1115.

persons providing the domestic service. The employment must consist

Worksheet: Complete this worksheet and transfer line entries to

exclusively of domestic service in the private home of the employer.

the corresponding line numbers on Form VA-6H below. Retain the

The first annual return and payment under the new filing status will be

worksheet for your records.

due on February 28, 2010. See Tax Bulletin 08-12, available on the

Lines 1 - 4: Enter the total quarterly wages in Column B and the total

Tax Policy Library at .

quarterly Virginia income tax withheld in Column C.

To register for this annual filing option, go to the Department’s website

Line 5: Enter the total of Virginia income tax withheld in Lines 1C

at and use iReg or complete and file Form

through 4C.

R-1H, also available on the Department’s website.

Line 6: Enter the amount of payments submitted during the period in

If total payroll exceeds $5,000 for any calendar quarter during the year,

Column C.

file and pay withholding taxes periodically during the year following

Line 7: Enter the net amount due in Column C.

the rules for businesses. Visit our website at

Line 8: Enter the total number of W-2 statements (state copy) sent

for more information.

with this return in Column C.

Form VA-6H must be filed by all employers registered to file and

C. Virginia Tax

pay household withholding annually. The Form VA-6H must be

A. Quarter

B. Total Wages

Withheld

accompanied by a Wage and Tax Statement (Form W-2, State copy)

1. First Quarter

for EACH employee the employer had during the year (including those

(January - March)

from whom no taxes were withheld).

2. Second Quarter

(April - June)

Filing Procedure: File form VA-6H and Form W-2, by February 28 of

3. Third Quarter

the year following the calendar year in which taxes were withheld from

(July - September)

employees. File and pay electronically using eForms or Business iFile

4. Fourth Quarter

at , or mail Form VA-6H with your payment to

(October - December)

the Virginia Department of Taxation, P.O. Box 27736, Richmond,

5. Total Virginia Income Tax Withheld Add lines 1C through 4C

Virginia 23261-7736. A return must be filed even if no tax is due.

If you file the return and/or pay the tax after the due date, a penalty

6. Payments (if any) Made During Period

will be assessed. The penalty is 6% of the tax due for each month or

7. Net Amount Due - Line 5 minus Line 6. If you overpaid, fill in the

fraction of a month, not to exceed 30%. For late filing and payment,

refund box on line 7C of Form VA-6H.

interest is assessed at the rate established in Section 6621 of the

8. Total Number of Statements - Enter the total number of

Internal Revenue Code, plus 2%.

W-2 statements sent with this return

Payments returned by the bank will be subject to a returned payment

Preparation of Return: Transfer the entries from the worksheet above

fee in addition to any other penalties that may be incurred.

to the corresponding line numbers on the Form VA-6H.

Change of Address/No Longer Employ Household Staff: If you

Declaration and Signature: Be sure to sign and date the return.

change your address or no longer employ household staff, send a

File and pay online at . It’s fast, easy and secure. Plus it’s free!

DETACH AT DOTTED LINE BELOW. DO NOT SEND ENTIRE PAGE.

Household Employer’s Annual Summary of Virginia Income Tax Withheld

Form VA-6H

Due February 28

VA Department of Taxation

(DOC ID 366)

For assistance, call (804)367-8037.

P.O. Box 27736

Richmond VA 23261-7736

Calendar Year

FEIN

1B. First Quarter Wages

2B. Second Quarter Wages

0000000000000000 3668888 00000

3B. Third Quarter Wages

4B. Fourth Quarter Wages

ACCOUNT NUMBER

5C. Total VA Tax Withheld

NAME

6C. Previously Submitted Payments

PHYSICAL ADDRESS

7C. Net Amount

Due from Line 7

CITY STATE ZIP

PHONE NUMBER

.

Refund

I declare that this return (including accompanying schedules and statements) has been examined by me and to the best

8C. Total Number of Statements

of my knowledge and belief is true, correct and complete.

Number of W-2 statements sent

with this return

Signature

Date

Do not write in the space to the right.

1

1