Clear Data

Help

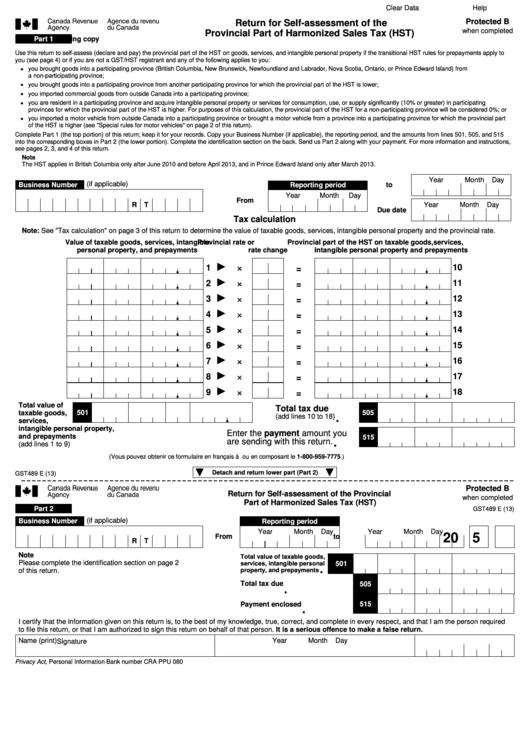

Protected B

Return for Self-assessment of the

when completed

Provincial Part of Harmonized Sales Tax (HST)

Part 1

Working copy

Use this return to self-assess (declare and pay) the provincial part of the HST on goods, services, and intangible personal property if the transitional HST rules for prepayments apply to

you (see page 4) or if you are not a GST/HST registrant and any of the following applies to you:

•

you brought goods into a participating province (British Columbia, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, or Prince Edward Island) from

a non-participating province;

•

you brought goods into a participating province from another participating province for which the provincial part of the HST is lower;

•

you imported commercial goods from outside Canada into a participating province;

•

you are resident in a participating province and acquire intangible personal property or services for consumption, use, or supply significantly (10% or greater) in participating

provinces for which the provincial part of the HST is higher. For purposes of this calculation, the provincial part of the HST for a non-participating province will be considered 0%; or

•

you imported a motor vehicle from outside Canada into a participating province or brought a motor vehicle from a province into a participating province for which the provincial part

of the HST is higher (see "Special rules for motor vehicles" on page 2 of this return).

Complete Part 1 (the top portion) of this return; keep it for your records. Copy your Business Number (if applicable), the reporting period, and the amounts from lines 501, 505, and 515

into the corresponding boxes in Part 2 (the lower portion). Complete the identification section on the back. Send us Part 2 along with your payment. For more information and instructions,

see pages 2, 3, and 4 of this return.

Note

The HST applies in British Columbia only after June 2010 and before April 2013, and in Prince Edward Island only after March 2013.

Year

Month

Day

(if applicable)

to

Business Number

Reporting period

Year

Month

Day

From

R T

Year

Month

Day

Due date

Tax calculation

Note: See "Tax calculation" on page 3 of this return to determine the value of taxable goods, services, intangible personal property and the provincial rate.

Value of taxable goods, services, intangible

Provincial rate or

Provincial part of the HST on taxable goods,services,

personal property, and prepayments

rate change

intangible personal property and prepayments

.

.

1

×

10

=

.

.

2

×

11

=

.

.

3

×

12

=

.

.

4

×

13

=

.

.

×

5

14

=

.

.

×

6

15

=

.

.

×

7

16

=

.

.

×

8

17

=

.

.

×

9

18

=

Total value of

Total tax due

.

.

taxable goods,

501

505

(add lines 10 to 18)

services,

intangible personal property,

Enter the payment amount you

and prepayments

.

515

are sending with this return.

(add lines 1 to 9)

(Vous pouvez obtenir ce formulaire en français à ou en composant le 1-800-959-7775.)

Detach and return lower part (Part 2)

GST489 E (13)

Protected B

Return for Self-assessment of the Provincial

when completed

Part of Harmonized Sales Tax (HST)

Part 2

GST489 E (13)

(if applicable)

Business Number

Reporting period

Year

Month

Day

Year

Month

Day

20 5

From

to

R T

Note

Total value of taxable goods,

Please complete the identification section on page 2

services, intangible personal

501

.

of this return.

property, and prepayments

Total tax due

505

.

.

515

Payment enclosed

I certify that the information given on this return is, to the best of my knowledge, true, correct, and complete in every respect, and that I am the person required

to file this return, or that I am authorized to sign this return on behalf of that person. It is a serious offence to make a false return.

Name (print)

Year

Month

Day

Signature

Privacy Act, Personal Information Bank number CRA PPU 080

1

1 2

2 3

3 4

4