Clear Data

Help

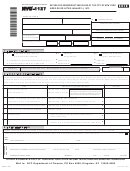

Completing Part 1

Allocated usage

Taxable amounts

per province %

Complete all boxes in Part 1 of the return. Part 1 is your working

copy. Make sure to keep it and any information you used to prepare

.

×

1

this return, in case we ask to see it.

.

×

Reporting period

2

.

Enter the reporting period that includes the day that the tax becomes

×

3

payable:

.

×

4

if you acquire goods in a non-participating province and bring

•

them into a participating province, you acquire goods in a

.

×

5

participating province with a lower HST rate and bring them into

.

×

a participating province with a lower HST rate, or you bring

6

imported commercial goods from outside Canada into a

.

×

participating province, the tax becomes payable on the day

7

the goods are brought into the participating province;

.

×

8

if you are the recipient of goods delivered or made available

•

to you, or sent by mail or courier from a non-registered

.

×

9

non-resident of Canada, the tax becomes payable on the

day the goods are delivered or made available to you in the

Value of taxable goods, services, intangible personal

participating province; and

property and total prepayments

for services and intangible personal property, the tax becomes

•

Multiply the "Allocated usage per province %" amount by the

payable on the day the consideration (purchase price that is

"Taxable amounts" from the above chart and enter the value for

most often a payment of money) for the supply is paid, or on the

which you must self-assess under the heading "Value of taxable

day the consideration for the supply becomes due, whichever

goods, services, intangible personal property, and prepayments"

date is earlier.

found on page 1. You must enter the calculated amounts on the

same line number.

The reporting period for non-registrants is the calendar month in

which tax became payable. Enter the first day and the last day of

Total value of taxable goods, services, intangible

that month.

personal property and total prepayments (line 501)

Due date

Add lines 1 to 9. This is the amount that is the "Total value of

The due date for this return is no later than the end of the month

taxable goods, services, intangible personal property, and

following the calendar month in which the tax became payable.

prepayments."

For example, if the tax becomes payable on July 15, 2013, the due

Provincial rate or rate change

date for the return is August 31, 2013.

Tax calculation

If you brought goods, services, or intangible personal property into a

participating province from a non-participating province, self-assess

To determine the value of taxable goods, services, intangible

the provincial part of the HST for that province. The provincial part of

personal property, and prepayments, complete the chart in the

the HST for each province is:

next column.

7% in British Columbia (after June 2010 and before April 2013);

•

Allocated usage per province %

8% in New Brunswick;

•

Goods

8% in Newfoundland and Labrador;

•

10% in Nova Scotia;

•

For goods brought into a participating province from a

non-participating province, or goods brought into a participating

8% in Ontario; and

•

province from another participating province with a lower HST rate,

9% in Prince Edward Island (after March 2013).

•

enter 100% in this column.

If you brought goods, services, or intangible personal property into

Services and intangible personal property

a participating province from another participating province and the

If you are bringing into a participating province taxable services

province you brought the goods, services, or intangible personal

or intangible personal property from a non-participating province, or

property into has a higher HST rate, self-assess the difference

from another participating province with a lower HST rate, you must

between the two rates. For example, if you brought goods into

determine the percentage of use for the service or intangible

Nova Scotia from Ontario, self-assess 2% (10% minus 8%).

personal property in each participating province.

If, under the HST transitional rules, you made prepayments on

Enter the percentage of use for which the person acquired the

taxable supplies made in Prince Edward Island, report 9%.

service, or intangible personal property. For example, if you required

Provincial part of the HST on taxable goods, services,

accounting services for your business located in two provinces, the

intangible personal property, and prepayments

use of the accounting services could be split 70% in one province

and 30% in the other province.

Multiply the amounts you entered on lines 1 to 9 by the "Provincial

rate or rate change" amount, and enter the results on the

Prepayments

corresponding lines 10 to 18.

For prepayments enter 100% in this column.

Total tax due (line 505)

Taxable amounts

Add lines 10 to 18, enter the result on line 505. This is the

In this column enter the value of the goods, services, or intangible

amount you will have to pay.

personal property that you acquired and brought into the

participating province.

Payment (line 515)

For instructions on how to make a payment, see "Completing Part 2"

on page 4.

Page 3

1

1 2

2 3

3 4

4